All About Axos Personal Loan

Finding the right personal loan can make all the difference when you’re managing big expenses, consolidating debt, or funding important life goals.

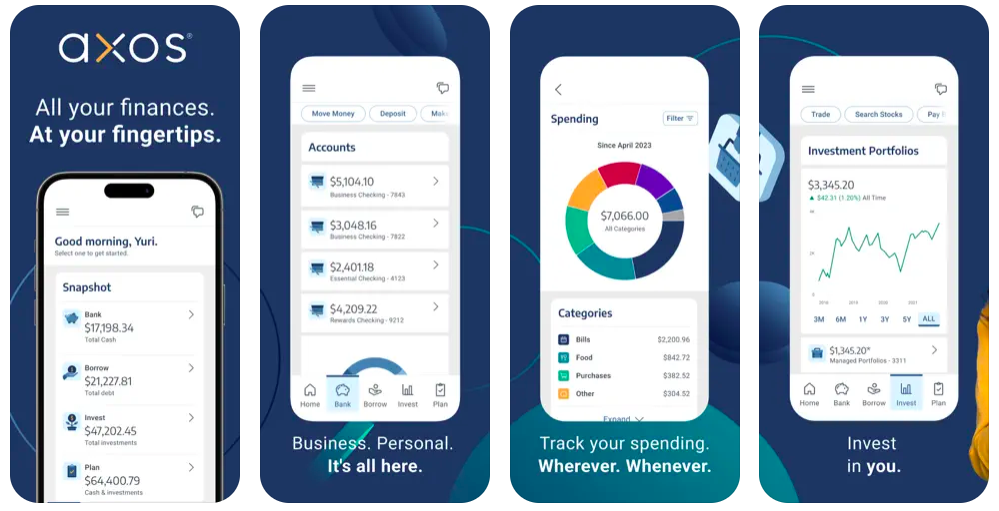

Among the many digital lenders available today, Axos Bank stands out for its seamless online application process, competitive fixed rates, and flexible repayment options that fit a wide range of borrowing needs.

As one of the most established online-only banks in the U.S., Axos combines trusted banking experience with modern lending technology, allowing qualified borrowers to secure funds quickly, often within just a day or two.

But how do Axos personal loans compare with other online lenders? And how can you be sure you’re getting the best deal possible?

That’s where Beem comes in. Beem’s platform lets you compare loan offers from multiple lenders, including Axos, so you can evaluate rates, terms, and repayment options side by side before you make a decision.

In this comprehensive guide, we’ll walk you through everything you need to know about Axos Personal Loans — from eligibility and features to benefits, drawbacks, and expert tips on finding your best loan option through Beem.

What Is an Axos Personal Loan?

Axos Bank is a U.S.-based digital bank that offers a variety of financial products, from checking and savings accounts to mortgages and auto loans. Its personal loan program is designed for individuals who want fast access to unsecured funds — meaning you don’t need to put up any collateral like your car or home.

An Axos personal loan can be used for almost any legitimate purpose, such as:

- Consolidating credit card debt

- Paying medical bills

- Making home improvements

- Covering relocation or wedding expenses

- Handling emergency costs

Because Axos operates entirely online, the application process is streamlined and paperless. You can check your rates, apply, and manage your loan — all from a computer or smartphone.

Key Features of Axos Personal Loans

Before deciding whether Axos is right for you, it’s important to understand the core terms and features that define its personal loan product.

Loan Amounts and Terms

Axos offers loan amounts typically ranging from $7,000 to $50,000, making it suitable for mid-size borrowing needs. Loan terms usually extend between three to six years (36–72 months), allowing flexibility in managing your monthly payments.

Interest Rates

The interest rate is fixed, which means your payment stays the same throughout the life of the loan. This predictability can make budgeting much easier. Your actual rate depends on factors like your credit score, income, and debt-to-income ratio.

Fast Funding

Once approved, Axos generally funds the loan within two business days, making it a competitive option for borrowers who need money quickly.

No Collateral Required

Axos personal loans are unsecured, so you don’t risk losing an asset if you can’t make payments. However, this also means your creditworthiness plays a significant role in whether you’re approved and what rate you receive.

No Prepayment Penalties

You can pay off your loan early without facing any extra fees. This flexibility is valuable if you receive extra income and want to reduce your interest costs by clearing your balance sooner.

Eligibility Criteria for an Axos Personal Loan

While Axos doesn’t publicize every qualification factor, most borrowers will need to meet certain general requirements:

- Strong Credit History – Borrowers with good to excellent credit (typically above 700) are more likely to qualify for the best rates.

- Proof of Stable Income – You’ll need to show that you can afford monthly payments.

- U.S. Citizenship or Permanent Residency – Axos personal loans are only available to U.S. residents.

- Low Debt-to-Income Ratio – Your existing debt compared to income should be within a manageable range.

Because Axos conducts an initial soft credit check, you can prequalify and view your estimated rate without damaging your credit score.

If you decide to move forward, a hard credit pull will be performed during final approval.

Benefits of Choosing Axos Personal Loans

There are several reasons borrowers are drawn to Axos Bank’s personal loans. Here are some of the most significant advantages.

1. Fully Digital Experience

From application to funding, everything happens online. You don’t have to visit a branch or mail physical paperwork, which saves time and simplifies the process.

2. Transparent, Fixed Terms

Your rate and payment remain constant for the entire loan term. You’ll always know how much you owe and when, which helps with consistent budgeting.

3. Fast Approval and Funding

Many borrowers receive a decision within a day and funds soon after. If you’re facing urgent financial needs, Axos’s quick turnaround is appealing.

4. No Hidden Fees or Prepayment Penalties

You can pay off your loan early without additional costs, helping you save on interest if your financial situation improves.

5. Suitable for Debt Consolidation

If you’re juggling multiple high-interest credit cards, an Axos personal loan can simplify repayment and potentially reduce your overall interest burden.

Potential Drawbacks to Consider

While Axos has many positives, it’s not the perfect fit for everyone.

1. Higher Minimum Loan Amount

With a minimum borrowing amount around $7,000, Axos may not be suitable for borrowers seeking smaller loans for minor expenses.

2. May Require Strong Credit

Borrowers with average or fair credit may face higher APRs or not qualify at all. Axos generally favors applicants with strong financial profiles.

3. Possible Origination Fees

Some users have reported origination charges deducted from their funded amount. Always check your loan agreement to confirm the actual fee structure.

4. Limited Accessibility

Since Axos is a digital bank, there are no physical branches. If you prefer in-person service, this may be a limitation.

5. Not Always the Lowest Rate

Depending on your credit score, other lenders may offer more competitive rates — which makes loan comparison essential.

How Beem Helps You Compare Loan Offers

One of the smartest ways to ensure you’re getting the best deal is to compare multiple lenders before you commit. That’s exactly what Beem helps you do.

Beem is a financial technology platform that lets you explore and compare personal loan offers from several trusted providers in one place. Instead of filling out multiple applications across different websites, you can enter your details once on Beem and view personalized offers side by side.

How Beem’s Personal Loan Platform Works

The Beem platform simplifies the loan shopping process into a few straightforward steps:

Step 1: Enter Your Loan Details

You start by providing your basic information — the loan amount you need, your estimated credit score range, and preferred repayment term.

Step 2: Get Personalized Offers

Beem checks your eligibility with its partner lenders and returns multiple loan options tailored to your profile. This process uses a soft credit inquiry, so it won’t impact your score.

Step 3: Compare and Choose

You can then review offers based on interest rates, monthly payments, and total repayment amounts. Beem’s interface makes it easy to identify which lender provides the best overall value.

Step 4: Apply and Fund

Once you select a lender, you can apply directly through Beem’s platform. The lender will handle final approval and disbursement of funds.

Why Use Beem Before Applying for an Axos Loan?

Even if you’re leaning toward Axos, it’s wise to compare your prequalified rate with other lenders. Here’s why:

- Rates Vary Widely – Personal loan rates differ based on the lender’s risk models. Beem helps you see where Axos stands relative to others.

- No Credit Impact for Prequalification – Beem’s soft inquiry means you can explore options freely.

- Transparency – You can evaluate multiple offers side by side, factoring in total interest costs, fees, and repayment terms.

- Convenience – Instead of visiting multiple lender websites, Beem consolidates everything in one dashboard.

This makes Beem an ideal tool whether you’re comparing Axos or exploring alternative options to suit your unique needs.

Axos vs. Other Lenders: What’s the Difference?

To help you visualize the value of comparison, here’s how Axos stacks up against other potential lenders you might find through Beem.

| Criteria | Axos Personal Loan | Other Lenders via Beem |

| Loan Amount Range | $7,000–$50,000 | Often as low as $1,000 and up to $100,000 |

| Interest Type | Fixed | Fixed or variable, depending on lender |

| Funding Speed | 1–2 business days | 1–5 business days (varies) |

| Minimum Credit Score | Around 700+ for best rates | May include lenders serving 580–650+ |

| Application Type | Online only | Online via Beem |

| Prepayment Penalty | None | Usually none, but varies |

| Prequalification | Available | Available through Beem platform |

| Collateral Required | No | Typically no |

From this comparison, it’s clear that while Axos caters mainly to prime borrowers, Beem’s platform gives access to a wider range of lenders, including those serving fair-credit borrowers or offering smaller loans.

When Axos Might Be the Right Choice

An Axos personal loan is likely a great fit if:

- You have excellent credit and want predictable, fixed payments.

- You’re looking to borrow at least $7,000.

- You want funds deposited quickly.

- You prefer dealing with a reputable digital bank with transparent terms.

- You plan to repay the loan early and appreciate no prepayment penalties.

In short, Axos works well for borrowers who value reliability and speed — especially those consolidating larger debts or financing significant projects.

When You Might Find a Better Option Through Beem

Beem could be the smarter route if:

- You need a smaller loan amount (under $7,000).

- Your credit score is fair or average, and you want lenders more flexible than Axos.

- You want to explore multiple loan options before committing.

- You prefer a platform that offers added benefits like cash advances, credit monitoring, and budgeting tools.

- You want transparency in comparing total repayment costs and fees from multiple lenders.

By using Beem first, you gain visibility into the full range of your loan options — potentially saving hundreds or even thousands of dollars over the life of the loan.

How to Apply for an Axos Personal Loan

If you decide to move forward with Axos after comparing your options, the application process is straightforward:

- Check Your Rate – Visit Axos Bank’s website and complete the prequalification form to view your potential rate and term.

- Submit a Full Application – Provide your personal, financial, and employment details.

- Upload Documents – You may need to share proof of income, bank statements, or identity verification documents.

- Receive Approval – Once approved, review and sign your loan agreement electronically.

- Get Funded – Expect to receive funds in your bank account within about two business days.

The entire process is designed for convenience and can typically be completed without phone calls or paperwork.

Practical Tips for Choosing the Right Loan

Whether you choose Axos or another lender through Beem, making an informed decision comes down to a few key considerations.

1. Evaluate the Total Cost

Don’t just look at the interest rate — factor in fees, origination charges, and total interest over the loan’s life.

2. Choose the Right Term

A longer term reduces monthly payments but increases total interest paid. Shorter terms cost less overall but require higher monthly commitments.

3. Mind Your Credit Score

A strong credit score not only helps you qualify but also unlocks lower interest rates. Check your credit report before applying.

4. Avoid Overborrowing

Borrow only what you need. Even though Axos offers up to $50,000, taking more than necessary can strain your finances.

5. Prequalify Before You Apply

Use prequalification tools to estimate your rates without hurting your credit. Beem makes this process simple across multiple lenders.

Why Loan Comparison Platforms Like Beem Matter

Many borrowers skip the comparison step and apply directly with one lender often overpaying as a result.

Using a platform like Beem ensures you see what’s available across the lending landscape before deciding.

Here’s why it makes sense:

- Saves Money: Even a 1–2% difference in APR can save you hundreds of dollars.

- Saves Time: One application gives you access to multiple offers.

- Empowers Decision-Making: You choose based on clear data, not guesswork.

- Protected Credit: Soft inquiries during prequalification don’t impact your score.

By leveraging Beem, you turn what could be a stressful, time-consuming search into a quick, informed comparison process.

Final Thoughts

An Axos personal loan is a solid choice for borrowers who value a straightforward, digital lending experience. With competitive fixed rates, no prepayment penalties, and fast funding, it suits individuals who need reliable financing for larger expenses or debt consolidation.

That said, the smartest financial decision always comes from comparing offers before applying. Using Beem’s loan comparison platform allows you to view multiple lenders’ terms side by side, helping you secure the most affordable rate available for your credit profile.

If Axos offers the best match, you can proceed confidently. If another lender through Beem beats the rate, you’ll have saved money simply by taking a few minutes to compare.

In short, Axos delivers dependability. Beem delivers perspective. Together, they make borrowing simpler, smarter, and more transparent for today’s consumers.

Common Questions About Axos Personal Loans Answered

What is an Axos Personal Loan?

An Axos Personal Loan is an unsecured loan offered by Axos Bank that lets you borrow a fixed amount of money for purposes like debt consolidation, home improvements, medical bills, or major purchases. Since it’s unsecured, you don’t need to provide collateral such as a house or car.

How much can I borrow with an Axos Personal Loan?

Axos Bank offers personal loans starting from $10,000 up to $50,000, depending on your credit score, income, and overall financial profile. Borrowers with higher credit scores and strong repayment histories often qualify for larger loan amounts.

What loan terms does Axos Bank offer?

You can choose repayment terms between 36 and 84 months (3 to 7 years). Longer terms come with lower monthly payments but higher total interest costs, while shorter terms save money on interest but require higher monthly payments.

How fast can I get funds from Axos Bank?

Once your application is approved and the loan agreement is signed, funds are usually deposited within 1 to 2 business days. Many borrowers receive their money as soon as the next business day.

Can I use Beem to compare Axos with other lenders?

Absolutely. Beem allows you to compare Axos Personal Loans with offers from other lenders, helping you find the lowest rates and most flexible terms available. Visit Beem’s Personal Loan Comparison Tool to explore prequalified offers without affecting your credit score.

Is Axos Bank a legitimate lender?

Yes. Axos Bank is a federally chartered digital bank that has been operating since 2000. It’s known for online banking services and transparent lending practices.

What credit score do I need for an Axos loan?

While Axos doesn’t specify a minimum score, applicants with credit scores above 700 tend to qualify for better rates and higher amounts.