Best 23 Apps Like MoneyLion

When you need cash quickly, waiting for your next paycheck can create real problems. Cash advance apps provide an immediate solution, allowing users to access funds for bills, urgent repairs, or other short-term financial needs without relying on traditional loans.

MoneyLion is one of the more popular apps in this space, offering cash advances, budgeting tools, and financial management features. But there are many other apps that provide similar services, each with different features, limits, and repayment options.

In this guide, we cover 23 top cash advance apps like MoneyLion, showing what each offers, how it works, and what sets it apart.

Whether you need fast cash, budgeting assistance, or financial guidance, these moneylion alternatives give you practical options to handle urgent expenses efficiently.

What Are Cash Advance Apps?

Cash advance apps are digital platforms that allow users to access money they have already earned, providing a convenient alternative to traditional loans.

Instead of waiting for your next paycheck, these apps advance a portion of your earned wages, helping you cover urgent expenses or manage short-term financial gaps.

Unlike conventional payday loans, many cash advance apps don’t require credit checks, making them accessible to a broader range of users.

These apps typically include a combination of features designed to make financial management easier and more flexible:

1. Instant Access to Funds

Cash advance apps allow users to receive money within minutes, often directly in their bank account or through a linked debit card. This immediacy is particularly helpful for covering unexpected costs like medical bills, car repairs, or utility payments.

2. Low or No Fees

Unlike high-interest payday loans, many cash advance apps operate with minimal fees or rely on optional tips. This approach makes short-term borrowing more affordable, allowing users to access cash without worrying about accumulating debt.

3. Budgeting and Financial Tools

Many apps go beyond just providing cash advances. They include features such as spending trackers, budgeting dashboards, and alerts to help users manage their finances responsibly. Some even offer guidance on saving and building emergency funds.

4. Flexible Repayment Options

Repayment is typically simple and automated. Most apps deduct the borrowed amount directly from your next paycheck, reducing the risk of missed payments or late fees. Some platforms also offer multiple repayment plans to suit different income schedules.

Who Benefits from Cash Advance Apps?

These apps are especially useful for individuals living paycheck to paycheck, gig economy workers with irregular income, or anyone facing a temporary cash shortfall. They provide a practical way to bridge financial gaps, maintain stability, and avoid the stress associated with delayed payments.

By offering fast access to earned wages combined with financial management tools, cash advance apps have become an essential resource for many Americans seeking short-term financial flexibility.

What is MoneyLion?

MoneyLion is a comprehensive financial platform designed to give users easy access to a wide range of money management tools, all in a single, intuitive app. It’s more than just a cash advance service—it’s an all-in-one financial hub that helps users manage their money, borrow responsibly, and build credit.

At the core of MoneyLion’s offerings is MoneyLion Cash Advance, also known as MoneyLion Instacash, which allows users to access up to $500 instantly. Unlike traditional payday loans, this advance is fast, flexible, and requires no hard credit check, making it an ideal solution for individuals facing unexpected expenses or short-term cash needs.

With MoneyLion Advance, users can cover bills, groceries, or emergency costs without worrying about complicated forms or hidden fees.Another standout feature is the credit builder loan like MoneyLion, which enables users to improve their credit score while borrowing responsibly.

By combining timely repayments with low-interest rates, these loans empower users to strengthen their credit history without the stress of high fees or excessive interest.

The MoneyLion dashboard provides a clear, user-friendly overview of all financial activities, including current account balances, upcoming payments, cash advance availability, and ongoing loans.

It also integrates budgeting tools and expense tracking, allowing users to make smarter financial decisions and maintain control over their spending.

Beyond advances and credit-building loans, MoneyLion offers personal loans, automated investing, and digital banking features, making it a truly holistic financial app.

Its mix of instant cash access, credit-building opportunities, and financial insights has made it one of the most trusted platforms for Americans seeking credit builder loans like MoneyLion, seamless cash advances, and a robust financial management experience.

23 Best Cash Advance Apps Like MoneyLion

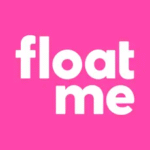

1. Beem

Beem is a versatile platform offering fast access to earned wages, similar to MoneyLion cash advance. With its Everdraft™ feature, users can get up to $1,000 instantly.

Unlike traditional lenders, Beem does not perform hard credit checks, making it ideal for users who want quick funds without affecting their credit score.

Why It’s a MoneyLion Alternative:

- Helps users manage short-term expenses like bills or emergencies.

- Instant cash access comparable to MoneyLion Advance.

- Integrated budgeting tools similar to the MoneyLion dashboard.

Fast funding, 24/7 access, and cashback perks make Beem the ideal financial backup for anyone who wants both emergency cash and a path to stronger money health.

| Pros | Cons |

| Lightning-fast access to funds | Maximum advances are based on account history |

| No credit check, no hidden fees | Subscription may be required for premium features |

| Includes budgeting tools and financial education | Instant funding sometimes carries a small express fee |

| Add-ons like insurance and free credit checks | Not all banking partners support every feature |

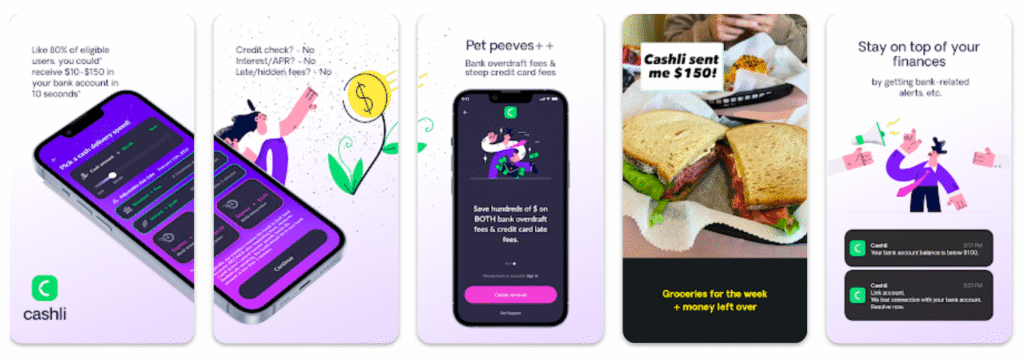

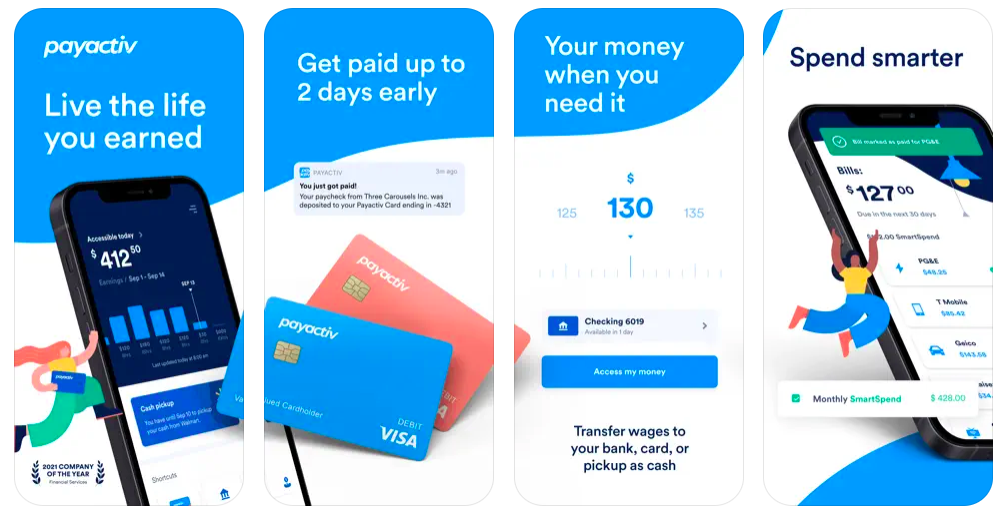

2. Payactiv

Payactiv is one of the standout cash advance apps like MoneyLion for workers whose employers offer it as a benefit.

Users can draw from already-earned wages before payday, pay bills, transfer funds, budget, and access financial wellness resources all within the app’s secure environment.

PayActiv partners with employers to offer access to earned wages, including direct utility bill payments. This app acts as a reliable MoneyLion alternative for employees with irregular schedules.

Features:

- Instant wage transfers comparable to MoneyLion Advance.

- Direct bill payments and financial wellness tools.

- No hard credit checks, keeping your credit score safe while accessing emergency cash.

It’s an excellent tool for employees looking for control and flexibility over when and how they get paid.

| Pros | Cons |

| Access a portion of earned wages anytime | Limited to participating employers |

| Integrated bill pay and savings features | Advance caps may be lower than some competitors |

| No credit checks or interest | May have small transaction or express funding fees |

| FDIC-insured pay card for added security | Cash advances are only for wages already earned |

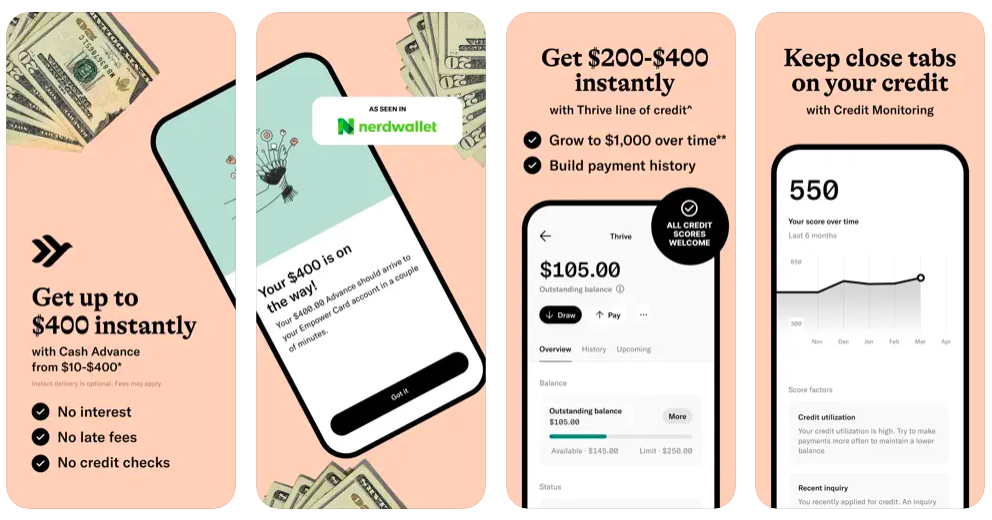

3. Empower

Empower is a top cash advance apps like MoneyLion that provides up to $400 instantly, along with a rewards debit card, automated savings, and spending alerts.

It stands apart for its personal finance AI, which analyzes your cash flow and suggests smarter spending. Its digital-first design, rapid funding, and seamless navigation make Empower an easy fit for users seeking both instant cash and hands-on money management.

| Pros | Cons |

| Fast, no-fee advances | Subscription required for some features |

| Personalized financial insights | Smaller cash advances for new users |

| Rewards debit card with cash-back | Express fees apply for instant transfer |

| Simple application and eligibility process | Not all banks integrate instantly |

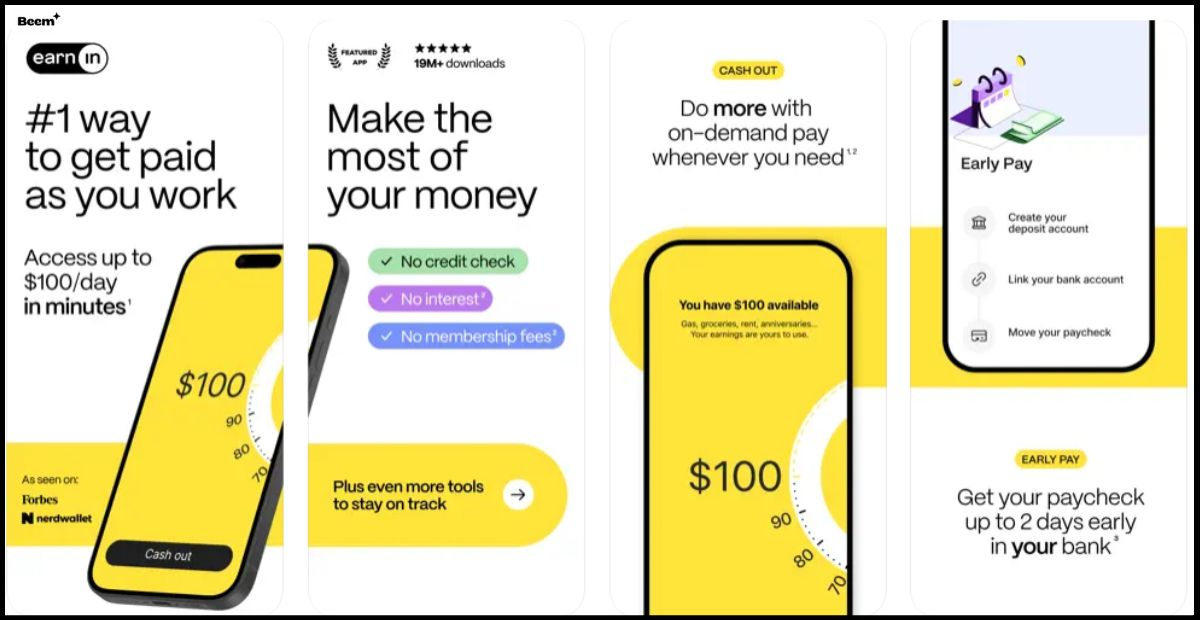

4. Earnin

EarnIn provides an optional tip-based model for withdrawing earned wages early. Its simple setup and instant transfer options make it a convenient alternative to MoneyLion cash advance.

Key Benefits:

- Quick access to wages before payday.

- Predictive cash flow alerts similar to features on the MoneyLion dashboard.

- Supports responsible borrowing without interest charges, similar to credit builder loans like MoneyLion.

Earnin is famous among cash advance apps like MoneyLion for its fee-free, tip-based model: borrow up to $750 of already-earned wages, pay what you want for service, and enjoy features like overdraft protection and balance alerts.

Earnin works well for those with predictable direct deposits and is especially valued for its transparency and speed.

| Pros | Cons |

| No mandatory fees or interest | Requires regular, predictable direct deposits |

| Instant delivery option for small fee | Limited to $100–$150/day, $750/pay period for most |

| Overdraft prevention via Balance Shield | Sometimes delays if payroll isn’t consistent |

| Simple setup, user-friendly interface | Tipping may pressure some users |

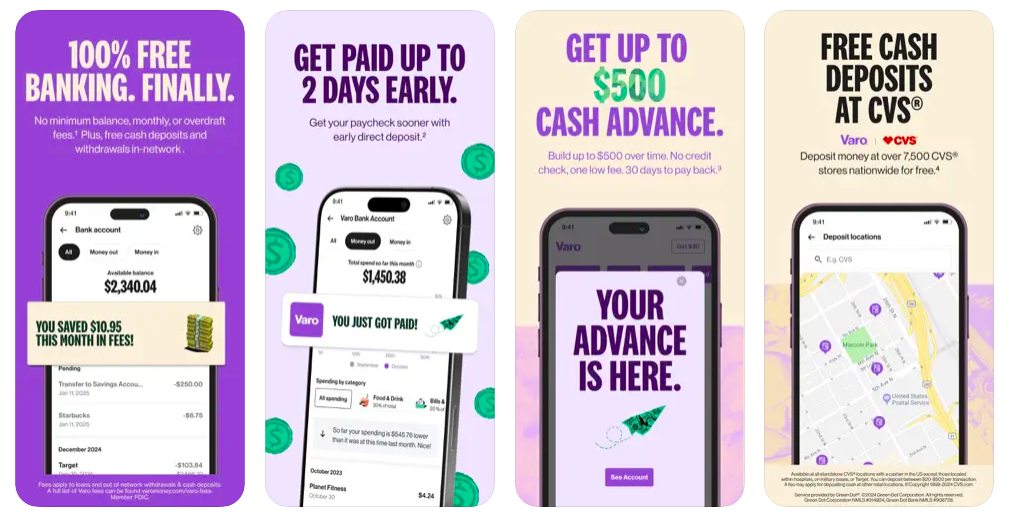

5. Varo

Varo Bank competes with the best cash advance apps like MoneyLion by offering up to $250 in instant advances, early direct deposit, fee-free overdraft, and robust savings rates.

Its modern app design, focus on credit-building, and digital-first banking tools make Varo a great all-around choice for users seeking financial empowerment without traditional bank hassles.

| Pros | Cons |

| No monthly fees or minimums | Advance limits may be low for new customers |

| High-yield savings and credit-builder card | Requires consistent direct deposit |

| Fast deposits and intuitive financial planning | Some features limited by account eligibility |

| Seamless, mobile-first experience | Advance features only for eligible users |

6. MoneyLion

As one of the most recognized cash advance apps, this original stands out for blending Instacash advances (up to $500), automated investing, personal loans, and in-depth credit monitoring.

Its seamless app experience combines budgeting, credit tools, and even cashback rewards—making it a one-stop shop for those who want everyday banking, borrowing, and building in a single platform.

| Pros | Cons |

| High instant advance limits | Some premium features require subscription |

| Automatic investing, credit tracking, and loans integrated | New users may have lower initial advance limit |

| Fast, user-friendly mobile app | Limits are based on income/deposit history |

| Multiple shortcuts to improve financial health | Instant transfers require qualified linked account |

7. Brigit

Brigit is well-known among cash advance apps like MoneyLion for predictive budget tools, real-time notifications, and advances up to $250.

It uniquely helps users avoid overdraft, discover side gigs, and build credit through its integrated builder tool—all on a clear, subscription-based pricing model.

| Pros | Cons |

| Credit Builder included in subscription | $9.99/month for full features |

| Predictive budgeting and expense alerts | Limits on initial cash advance |

| Fast approvals and easy top-ups | Not everyone is eligible for credit builder |

| Early warnings for bill payment risk | Standard transfer times can take 1–2 days |

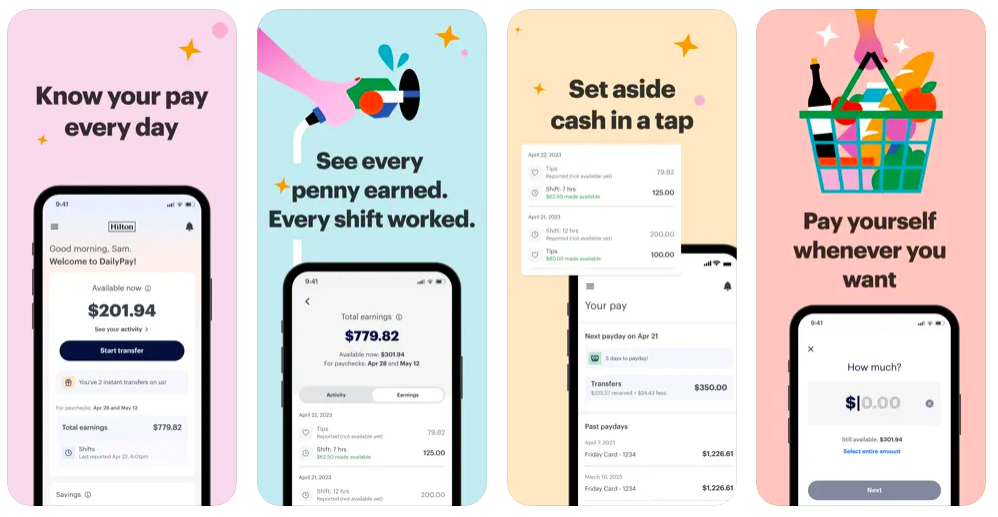

8. DailyPay

DailyPay is a fast-growing financial platform that allows employees to access the money they’ve already earned—before their official payday.

By partnering directly with employers, DailyPay makes it possible to transfer a portion of earned wages instantly, giving users the flexibility to handle unexpected expenses without relying on credit cards or payday loans.

Key Features:

- Instant Wage Access: Users can receive a portion of their earned pay immediately, helping cover bills, groceries, or emergencies.

- Flexible Transfer Options: Funds can be sent directly to a bank account, debit card, or prepaid card for convenience.

- Financial Visibility: DailyPay offers real-time tracking of earned wages, enabling better planning and budgeting.

- Savings Tools: Built-in features allow users to set aside funds for specific goals, creating a simple way to save while managing daily finances.

Why It’s a MoneyLion Alternative: DailyPay functions similarly to MoneyLion cash advance, providing rapid access to funds without credit checks. Its real-time wage tracking and savings tools give users a level of financial control similar to the MoneyLion dashboard.

With transparent fees and no interest, it’s a safe and cost-effective option for managing cash flow between paychecks.

Best For:

- Employees seeking early access to earned income.

- Anyone who wants to avoid late fees or overdraft charges.

- Users who want financial flexibility and visibility while staying in control of their money.

Access your paycheck as soon as you’ve earned it, move funds instantly, and avoid costly payday loans. Its payroll integration makes it an essential resource for anyone who needs flexibility between pay cycles.

| Pros | Cons |

| Access any portion of earned wages daily | Only available via partner employers |

| No credit check, and funds move instantly | Fees may apply for instant transfers |

| Built-in savings tools and tracking | Limited control for freelance or gig work |

| Reliable for fast, scheduled pay | Advance only up to wages already earned |

9. Albert

Albert is more than a cash advance app like MoneyLion—it’s a financial wellness hub combining up to $250 advances, automated savings, investment management, and expert financial advice.

With the “Albert Genius” subscription, users can chat with real human advisors about goals, debts, or savings strategies—all while accessing fee-free advances and smart budgeting tools.

| Pros | Cons |

| Connects banking, saving, and investing | Genius subscription unlocks most features |

| Advance eligibility based on account health | Customer support prioritizes Genius users |

| Fast advance delivery (typically 2–3 hours) | Advances start low and build over time |

| Real-time notifications and coaching | Tips encouraged for some services |

10. Chime

Chime stands out among cash advance apps like MoneyLion with its SpotMe feature—offering up to $200 in fee-free overdraft. It combines digital banking with early direct deposit, robust savings, credit-building tools, and a frictionless mobile app.

SpotMe coverage and seamless experience make Chime a go-to for cash advances plus everyday banking.

| Pros | Cons |

| No overdraft, maintenance, or hidden fees | Direct deposit required for SpotMe, advances |

| Early paycheck access | Overdraft cap starts low, rises over time |

| Sleek mobile interface and notifications | Some locations/features limited by eligibility |

| Strong security and user support | Cash advances limited for some account types |

11. PockBox

PockBox carves a niche among cash advance apps like MoneyLion by connecting users to up to 50 online lenders, aggregating personal loan offers between $100 and $2,500.

Its rapid, single-form application and instant decision-making ensure users can compare rates and terms without visiting multiple sites, maximizing choice and transparency.

| Pros | Cons |

| Access to dozens of lenders instantly | Not a direct lender—matches offers |

| Easy, fast one-form application | Some lenders may perform hard credit check |

| Customizable loan amounts from $100–$2,500 | APRs and fees vary widely between lenders |

| Compare multiple terms and offers at once | Approval not guaranteed for all users |

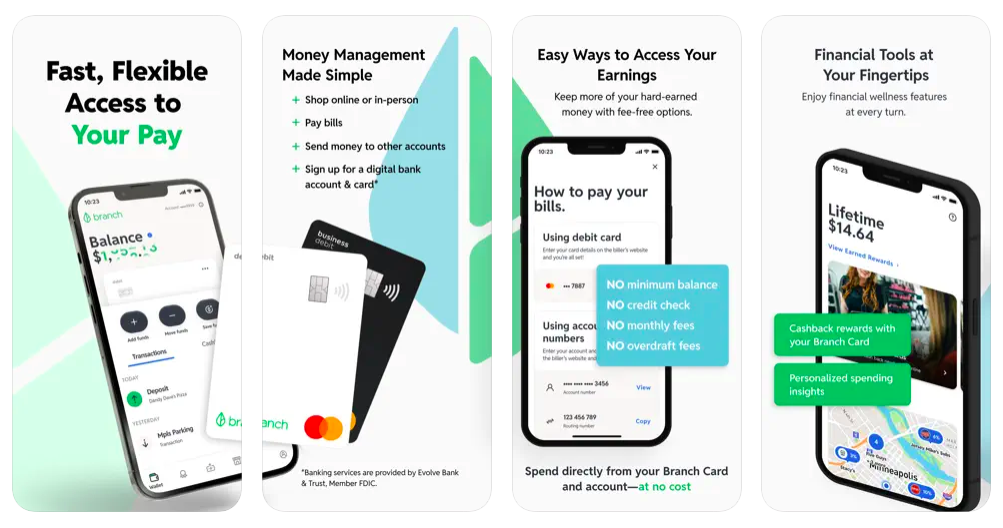

12. Branch

Branch excels among cash advance apps like MoneyLion, specializing in advances for gig economy and hourly workers. Users can cash out up to 50% of their earned wages for free, manage schedules and expenses, and monitor budgeting—all in one mobile dashboard.

| Pros | Cons |

| Free advances up to 50% of earned wages | Requires participation by employer/gig platform |

| No credit checks or interest | Not all businesses support Branch |

| Built-in work management and expense tracking | Advance limits based on shifts worked |

| Real-time banking and instant payments | Funding times depend on payroll integration |

13. Loan Solo

Loan Solo is a cash advance app like MoneyLion that facilitates safe, fast connections between users and hundreds of lenders. Advance options range from $100 to $1,000, making it easy to find emergency funding with a straightforward, mobile-based application process.

| Pros | Cons |

| Vast network of lending partners | Not a direct lender |

| Instant application and offers | Approval requirements vary per lender |

| No upfront fees or hidden charges | Rates and fees are lender-dependent |

| Safe, secure user experience | Funds usually delivered next business day |

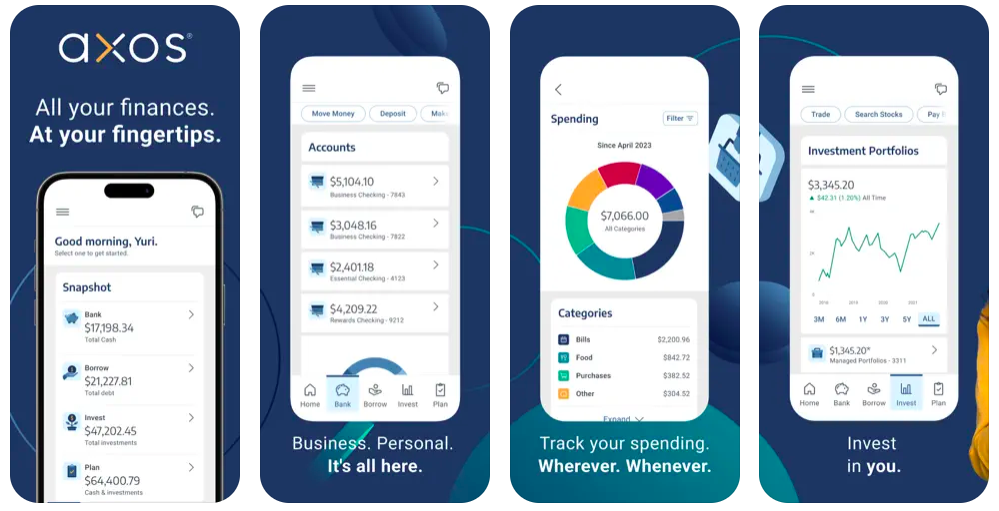

14. Axos Bank

Axos stands out within cash advance apps like MoneyLion for its hybrid approach: enjoy digital-only checking and savings with no monthly fees, robust high-yield savings, instant funds transfers, and a marketplace of loan products. Axos also specializes in seamless bill pay and customizable financial insights.

| Pros | Cons |

| Highly customizable digital accounts | Full advances limited to eligible account types |

| Top-tier mobile features and security | Savings APYs fluctuate with market |

| Diverse selection of banking and loan products | Approval required for loan/cash advance |

| Unlimited domestic ATM fee reimbursements | No physical branches |

15. FloatMe – Fast Cash Advance App

FloatMe is a minimalist cash advance app like MoneyLion focusing on subscription-based, small-dollar advances of up to $100.

It provides advance tracking, overdraft prediction, and smart alerts to help users stay on top of cash shortages, and it’s especially effective for students, freelancers, and anyone prone to overdraft.

| Pros | Cons |

| No credit check, no interest | $1.99–$2.99/month subscription |

| Streamlined eligibility and rapid delivery | Maximum advances are small initially |

| Overdraft and balance tracking | No budgeting or investing tools |

| Fast, predictable account monitoring | Repayment due automatically with next deposit |

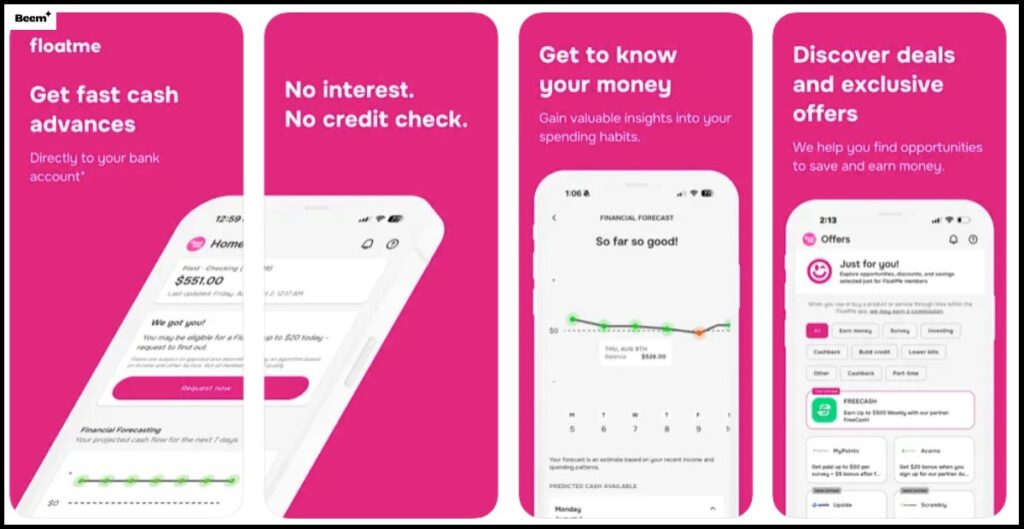

16. PocketGuard

PocketGuard adds another layer of clarity among cash advance apps like MoneyLion by helping users analyze all financial life in one dashboard. While primarily a budgeting tool, it links to bank and credit card accounts, helps users optimize spending, track bills, and discover money they didn’t know they had—freeing up cash before a real advance is even needed.

PocketGuard Pros and Cons

| Pros | Cons |

| Powerful budgeting and bill tracking | Limited direct cash advance options |

| Links all accounts for quick financial overview | True advances must be sourced externally |

| Helps find extra money to free up cash | Some features require premium upgrade |

| “In My Pocket” feature simplifies what you have to spend | Lacks instant lending when emergencies arise |

17. Gerald

Gerald sits among cash advance apps like MoneyLion for its mission to help users avoid costly overdraft fees and late payments. Its instant advances (up to $200 for eligible users) come with an integrated buy-now-pay-later tool, bill payment automation, and smart financial alerts.

| Pros | Cons |

| Free and fast advances for eligible accounts | Advance caps may be lower for new users |

| Integrated bill pay and BNPL functions | Limits based on account history |

| Overdraft and late fee notifications | Not all users will qualify |

| Simple interface and reliable automated payments | Customer support can be slow |

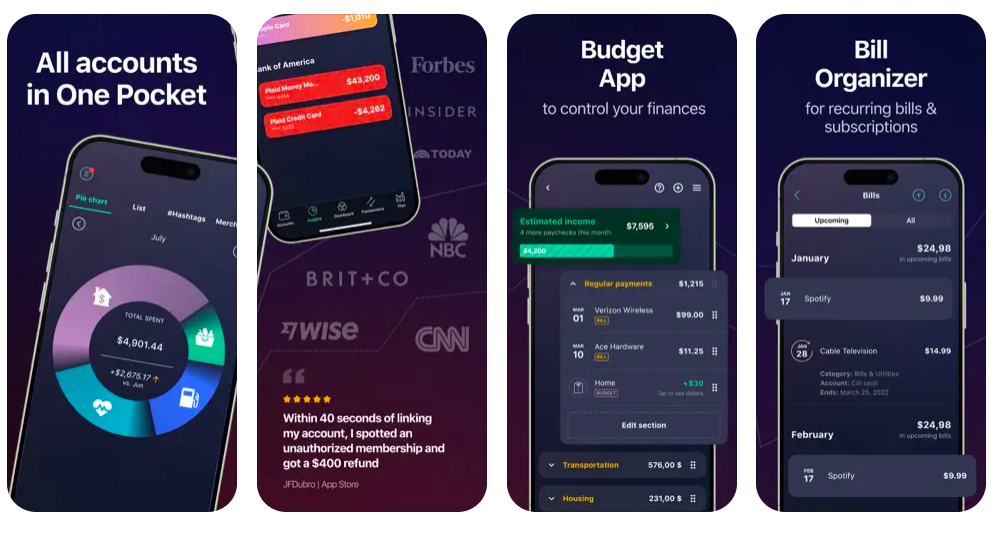

18. Grid Money

Grid Money is one of the newest cash advance apps like MoneyLion, targeting gig workers with advances up to $200, flexible repayment, and digital banking. It combines instant funding with a Visa debit card, direct deposit, and a feature-rich dashboard for complete financial control.

| Pros | Cons |

| Advances for gig and hourly workers | Only available to Grid cardholders |

| Fast funding tied to direct deposit | Starting advance limits may be low |

| Debit card, banking, and budgeting in one place | Insufficient account history may limit approval |

| Sleek user interface and analytics | Some advanced features in premium plan |

19. Possible Finance: Fast Cash & Credit

Possible Finance is a unique credit-building platform among cash advance apps like MoneyLion. It replaces traditional short-term advances with small installment loans that report each payment to the major credit bureaus, helping users grow their score and get out of the payday loan trap.

Possible Finance: Pros and Cons

| Pros | Cons |

| No hard credit checks | Interest and fees are higher than basic advances |

| Payments reported to all major credit bureaus | Installment format, not single-advance |

| Builds credit safely over time | Lower borrowing limits for some users |

| 24/7 access to approval and instant funds | Not a direct cash advance; scheduled payments |

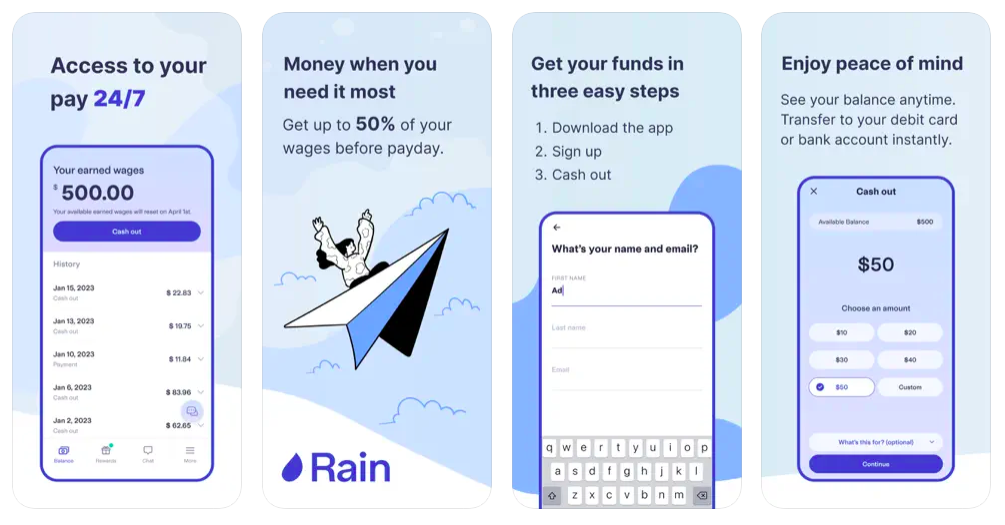

20. Rain Instant Pay

Rain Instant Pay makes the list of top cash advance apps like MoneyLion for its ability to instantly send out earned wages, so users get paid on their terms. This employer-integrated platform gives hourly and gig workers full control of their cash flow, slashing the delays of traditional payroll.

Rain Instant Pay: Pros & Cons

| Pros | Cons |

| Employers enable real-time wage access | Only available through partner businesses |

| Fast funds 24/7 | Max advances tied to earned but unpaid wages |

| Predictable, flat fees | Some workplaces still on traditional payroll timing |

| No interest, no credit check | Funds advance is capped by net earnings |

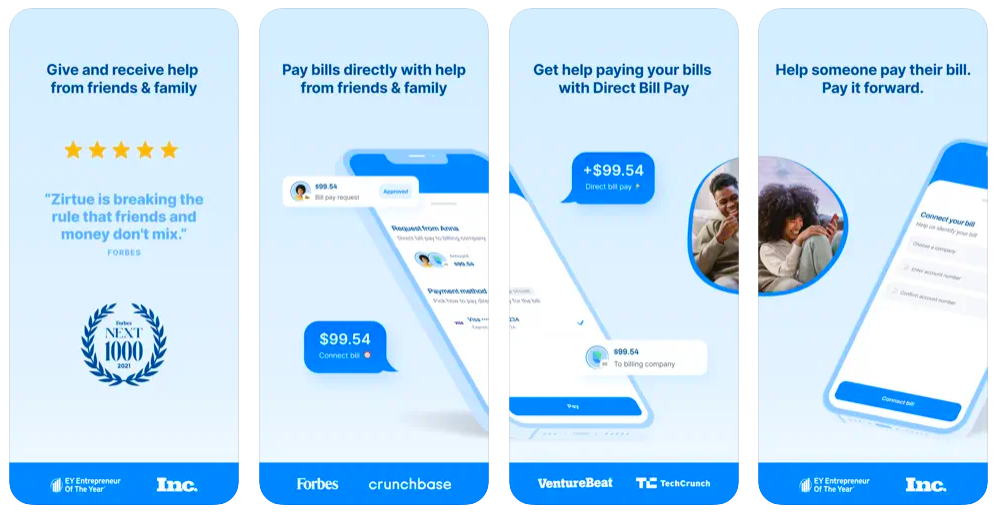

21. Zirtue: Lend & Borrow Money

Zirtue is a peer-to-peer lending platform among cash advance apps like MoneyLion, simplifying loans between family, friends, or colleagues. Structured terms safeguard relationships and automate repayment, offering an innovative alternative to apps relying on institutional funding.

| Pros | Cons |

| Safe, formalized personal loans | Relies on social/family willingness |

| Streamlined documentation and automated repayment | Not for true emergency needs if network unavailable |

| Flexible terms and interest settings | Loans may not always be instant |

| Builds trust and credit with close contacts | Repayment depends on social agreement |

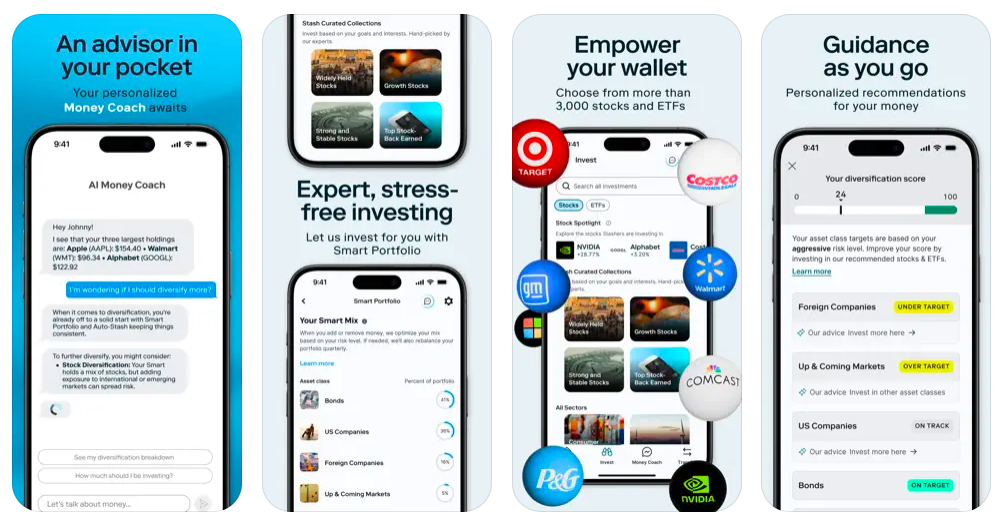

22. Stash: Investing made easy

Stash is a standout among cash advance apps like MoneyLion thanks to its focus on both spending power and wealth-building. With Stash, users can access a mobile bank account with a debit card, early payday, automatic saving, and round-up investing into fractional stocks or ETFs, all from the same dashboard.

While Stash doesn’t provide conventional cash advances, its overdraft protection and “instant available cash” when you sell investments give users a cash-flow solution paired with powerful, long-term financial tools.

| Pros | Cons |

| One app for banking, saving, and investing | Cash advance options are indirect |

| Fractional investing and goal tracking | Monthly subscription for banking/invest |

| Early payday and automatic saving | Overdraft/cash access based on portfolio |

| Debit card with rewards | Funds not as instant as some competitors |

23. Cash App

Cash App is widely used for instant peer-to-peer payments, but is quickly emerging as one of the cash advance apps like MoneyLion through its recent borrow feature. Qualified users can draw up to $200, enjoy instant transfers, Bitcoin trading, direct deposit, and a personalized debit card—all in a user-friendly app.

| Pros | Cons |

| Instant cash access and direct peer transfers | Borrow feature not available to all users |

| Modern debit card, direct deposit, and investing | Advance limits scale with activity |

| Easy to send money between users | Loan fees and repayments are auto-scheduled |

| Small advances bridge gaps without paperwork | Occasional delays due to verification |

What to Consider When Choosing Cash Advance Apps Like MoneyLion

When exploring cash advance apps like MoneyLion, it’s important to evaluate several key factors to ensure you choose a platform that fits your financial needs and goals.

These apps can vary widely in terms of limits, fees, features, and repayment requirements, so taking the time to compare them will help you make an informed decision.

1. Advance Limits & Fees

Different apps offer different borrowing limits, typically ranging from $50 up to $500 or even $1,000 for premium users. Some apps may hold a portion of your advance in a reserve account until repayment, as with MoneyLion’s credit builder loans.

It’s also essential to check for any fees or optional tips, as some apps charge small service fees for expedited delivery or monthly subscriptions. Knowing the exact cost upfront can help you avoid surprises and plan your repayment effectively.

2. Funding Speed

If you need cash immediately to cover bills or emergencies, the speed at which an app transfers funds is critical. Many apps like MoneyLion, offer instant deposits for advances, while others may take a day or two. Assess whether you need immediate access or can afford a slightly slower transfer.

3. Eligibility & Repayment

Most cash advance apps require steady income or direct deposit to qualify for advances. It’s important to understand how each platform evaluates eligibility and how repayments are handled.

Automatic repayment tied to your next paycheck is common, which can simplify the process but also requires careful planning to avoid overdrafts.

4. Extra Features

Some apps go beyond simple advances and offer additional financial tools. For instance, MoneyLion provides credit building, investing, and budgeting tools in addition to cash advances.

If you value long-term financial growth and management, choosing an app with multiple features can add significant value.

5. User Support & Security

A reliable app should have strong security protocols to protect your banking information and personal data.

Check for customer support availability, app ratings, and user reviews to ensure that help is available when needed. Responsive support can make a big difference during urgent financial situations.

6. Transparency

Finally, transparency is crucial. Ensure all terms, including advance limits, fees, eligibility criteria, and overdraft rules, are clearly stated from the start. Avoid apps with hidden charges or confusing repayment structures, as these can quickly turn a helpful cash advance into a financial headache.

By carefully considering these factors, you can select the best cash advance app like MoneyLion for your specific financial needs—whether you’re looking for instant funds, credit-building opportunities, or a full suite of personal finance tools.

Cash Advance Apps Like MoneyLion: Quick Comparison Table

| App Name | Max Advance | Credit Check | Funding | Best Features | Best For |

| Beem | $1,000 | No | Instant | Everdraft™, tools, insurance | All-in-one |

| Payactiv | Varies | No | Same day | Wage access, wellness | Employees |

| Empower | $250 | No | Instant | AI, budgeting, rewards card | Smart banking |

| Earnin | $750/period | No | Instant | Tip-based, overdraft alerts | Salary workers |

| Varo | $250 | No | Instant | Early pay, overdraft | Digital savings |

| MoneyLion | $500 | No | Instant | Investing, credit, rewards | All-in-one users |

| Brigit | $250 | No | 1–2 days | Credit build, budgeting | Financial health |

| DailyPay | Varies | No | Same day | Employer-integrated | Hourly/gig work |

| Albert | $250 | No | Hours | Genius advice, save, invest | Coaching |

| Chime | $200 | No | Immediate | Overdraft, early pay | Neobank fans |

| PockBox | $100–$2,500 | Soft/hard | 1–2 days | Multiple lenders, big range | Loan comparers |

| Branch | 50% of earned | No | Same day | Free, gig focus | Shift workers |

| Loan Solo | $1,000 | Soft/hard | Next day | Lender network, instant | Quick loans |

| Axos | Varies | Soft | 1-2 days | High-yield, digital bank | Savers, spenders |

| FloatMe | $100 | No | 1–2 hours | Overdraft protection | Subscription fans |

| PocketGuard | N/A | N/A | N/A | Budgeting, tracking | Spending control |

| Gerald | $200 | No | 1–2 days | BNPL, bill pay, alerts | Bill avoiders |

| Grid Money | $200 | No | Instant | Gig advances, digital bank | Gig workers |

| Possible Finance | $500 | No | 1–2 days | Credit building, installment | Score boosters |

| Rain Instant Pay | Up to earned | No | Instant | Employer wage, fee control | Payroll on demand |

| Zirtue | Varies | Social/net | Agreed term | P2P, trust, automated repay | Family, friends |

| Stash | Indirect via overdraft cover or “instant available cash” after selling investments (typically $50–$200, varies by user and activity) | No | Same day for available cash after investment sale; direct deposit available for paychecks | One-stop app for banking, early payday, debit card with rewards, automatic saving, round-up investing, portfolio building, and fractional stock/ETF purchases | Users seeking a blend of digital banking, cash management, and investing in a single app; ideal for those wanting to save and invest their spare cash while still having flexible access when needed |

| Cash App | $200 | No | Instant | P2P, investing, debit card | Everyday use |

Frequently Asked Questions About Apps Similar to Moneylion

Is there any other app like MoneyLion?

Yes, there are many apps like MoneyLion. Top alternatives include Beem, which offers instant cash advances with extras like budgeting and credit tools; Payactiv, which gives early wage access through employers; and Earnin, which lets you get money you’ve already earned before payday with no mandatory fees. Each offers fast access to funds and unique financial tools for different needs.

Is there an app similar to MoneyLion?

If you’re searching for an app that closely matches MoneyLion, Beem is the best choice. Beem provides instant cash advances up to $1,000 with its Everdraft™ feature—no credit checks, no interest, and flexible repayment.

Like MoneyLion, it also includes budgeting support, free credit monitoring, insurance benefits, and cashback rewards, all within one user-friendly app. Beem is perfect for those who want fast financial support and broad money management tools in a single platform.

Are there alternatives to MoneyLion and EarnIn?

There are many alternatives to MoneyLion and EarnIn that offer fast cash access, flexible eligibility, and extra financial tools.

Top options include Beem for instant advances and budgeting, Dave for quick cash and gig work support, and Brigit for overdraft protection plus credit building. Each app tailors its features for different income types and financial needs.

What is the MoneyLion cash advance limit?

The MoneyLion cash advance limit typically ranges from $50 to $500 per advance. The exact amount you can access depends on factors such as your account history, income verification, and spending patterns.

How much money does MoneyLion let you borrow?

MoneyLion has a credit builder loan specifically designed to help you improve your credit score. For $19.99 a month, MoneyLion allows you to borrow between $500 and $1,000. A portion or all of the borrowed funds may be placed in a reserve account, which you can access once the loan—plus any interest—is fully repaid, usually within 12 months. This structure helps you build credit responsibly while providing a clear path to accessing your funds.

Key Takeaways

The rise of MoneyLion cash advance and credit builder loans like MoneyLion has opened the door for a variety of MoneyLion competitors in the financial app space.

These alternatives aim to provide users with instant access to funds, flexible repayment options, and budgeting tools similar to the MoneyLion dashboard.

Popular MoneyLion competitors such as Beem, Dave, Brigit, Grid Money, and EarnIn offer quick cash advances that help cover emergency bills or unexpected expenses without high-interest rates or credit checks.

Other apps like Chime, PayActiv, Albert, and Empower go a step further by combining financial tracking, savings guidance, and responsible borrowing features, making them strong contenders among MoneyLion competitors.

For gig workers, freelancers, and anyone living paycheck to paycheck, these platforms provide an accessible way to manage cash flow and maintain financial stability.

Exploring MoneyLion competitors allows users to find a solution that fits their unique needs, whether that’s immediate cash, credit-building options, or a comprehensive financial management dashboard.

Overall, MoneyLion competitors continue to grow in popularity, offering robust alternatives for Americans seeking quick, reliable, and user-friendly financial tools.

The world of cash advance apps like MoneyLion is full of powerful tools—putting faster cash, smarter budgeting, credit growth, and even social or employer-backed features in your hand.

Start with Beem for flexible limits and instant funding, or branch out to find the perfect match for income type, financial habits, and money goals. Use these apps responsibly, see them as a backup when you’re in a pinch, and let them help build real financial freedom—not just cover today’s bills.