Summary

If you’re exploring upstart personal loans, you’re not alone. With innovative underwriting and an easy upstart loan application process, Upstart has become a popular choice.

In this guide, we’ll cover the entire journey—from understanding what does Upstart require for a loan to estimating upstart loan approval time, including how to use debt consolidation Upstart to simplify your finances.

Upstart is a technology-based lending platform that helps you get personal loans conveniently. It checks your eligibility criteria to find the loan amount limit. Unlike traditional lenders, Upstart assesses applicants beyond just credit scores.

They consider factors like education, employment history, and more to provide more accurate and fair lending decisions. This innovative approach helps to expand access to credit and provides individuals with more opportunities for financing.

This article provides a step-by-step guide to applying for loans at Upstart. You can learn more about eligibility criteria and other essential documents to help you ensure the application process is successful. Whether you’re new to personal loans or looking to explore Upstart’s offerings, this guide has you covered.

Get the best deals for personal loans with Upstart today! Visit the website to explore more details!

Overview of Upstart Personal Loans

What Are Upstart Personal Loans?

Upstart was started in 2012 and is a personal provider. They use alternative data to determine borrowers’ eligibility. They offer competitive rates to lenders based on their academic history despite their low credit scores.

With AI-driven information, they check your financial history to evaluate your financial status. This is why they approve loans to those whom other lenders might reject. You need at least a credit score of 300 to qualify for personal loans from Upstart.

Upstart personal loans are unsecured loans between $1,000 and $50,000. Unlike traditional lenders, Upstart considers more than your credit score—they evaluate your education, employment, and debt-to-income ratio too. This makes Upstart personal loans accessible even to those with limited credit history.

Key Features of Upstart Personal Loans

Loan Amounts and Terms

Upstart offers personal loans ranging from $1,000 to $50,000, providing flexibility to meet various financial needs. Loan terms typically range from 36 to 60 months, allowing borrowers to choose a repayment period that best suits their budget.

Interest Rates and Fees

Upstart provides competitive interest rates based on the borrower’s financial profile. Rates generally start as low as 6.18% APR, depending on factors like creditworthiness and income. Upstart charges an origination fee, typically from 0% to 8%, deducted from the loan amount upon disbursement.

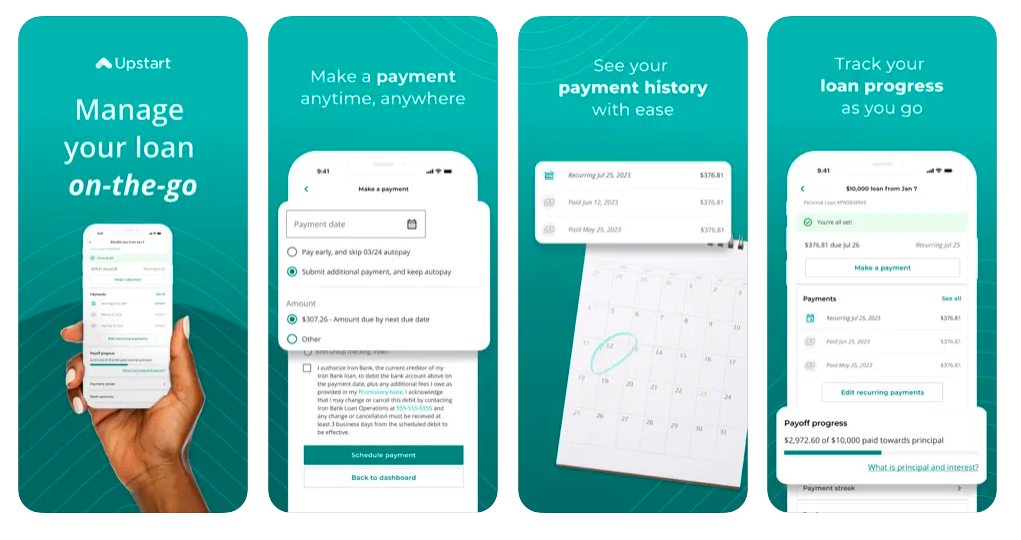

Digital Application Experience

The online application process with Upstart is simple and efficient, allowing you to apply in minutes. Their AI-driven platform quickly evaluates your eligibility and provides loan offers with a fast decision-making process, often within one business day.

Additional Benefits

Upstart offers a range of perks, including quick approval times and flexible repayment options. Borrowers can also access a convenient online portal to manage their loans, make payments, and track progress, all from the comfort of their devices.

What Does Upstart Require for a Loan?

Thinking “what does Upstart require for a loan?”—here’s the scoop:

- A minimum credit score of around 300 (much lower than typical lenders), yet the exact criteria depend on your full profile.

- Income or employment information is reviewed—so have your pay stubs or bank statements ready.

Financial history, including debts and repayment behavior, will also be assessed to estimate your ability to manage payments. Knowing what does Upstart require for a loan helps you prepare smartly before starting the upstart loan application process.

How to Get a Personal Loan from Upstart – Step-by-Step Process

Step 1: Evaluate Your Financial Situation

Every borrower must start their borrowing journey with a financial evaluation. It is a great way to ensure you can afford the loan you seek. You can check your credit history to review your finances and check if your credit score meets the lender’s eligibility criteria. Your credit history lets you go through your past financial achievements and allows you to resolve any errors.

Step 2: Define Your Loan Requirements

Calculating the Loan Amount

First, estimate the right loan amount to guarantee you borrow just what you need without overstretching yourself financially. Consider the overall cost, including any related and origination fees, which can lower the actual amount you get. One should find a compromise between keeping reasonable loan terms and getting enough money.

Clarifying the Loan Purpose

You must have a definite loan purpose. Most people who take a loan for a different purpose but spend it on other means might get into legal trouble. If you do not want to disclose the exact reason for the loan, you should consider personal loans. Otherwise, you can only get loan approvals for home, education, or car loans if you spend the loan amount on the type of loan you applied for.

Selecting a Repayment Term

The length of your repayments significantly affects your financial obligations. Usually spanning 24 to 60 months, loan terms let you customize the repayment plan depending on your financial situation and objectives. Here’s how varying loan terms could impact you:

- Shorter terms: Lower overall interest paid but higher monthly payments.

- Longer terms: Reduced monthly payments but more outstanding total interest charges over time.

Step 3: Research and Compare Upstart’s Offerings

Navigating the Upstart Platform

Many lenders offer a range of interest rates for personal loans. You can explore personal loans and other loan options by Upstart on its website or mobile app. This way, you can understand deals and the terms and conditions associated with the app.

Understanding Terms and Conditions

You must review the loan details in depth. This will help you understand the fine print and learn about interest rates, fees, and repayment conditions.

Competitive Comparison

Upstart offers competitive rates for borrowers despite poor credit history. It provides a better deal on personal loans than other personal loan providers. It is better to compare different loan providers and research their loan terms in detail. It will help you get affordable deals and loan amounts for your needs.

Step 4: Gather and Prepare Your Documentation

Required Financial Documents

Get ready with the following necessary paperwork to speed up the application process:

- Driver’s license, passport, or state ID—government-issued ID

- Pay stubs, tax returns, or bank statements—proof of income

- Evidence of residence—lease agreements, mortgage statements, utility bills, etc.

- Records on debt and expenses, should one be seeking debt consolidation

Presenting the required paperwork beforehand helps avoid delays and raises your loan acceptance chances.

Organizing Your Information

- Sort your paperwork ahead of time to guarantee a seamless application process:

- Check all personal information across several records.

- Make sure your income and expenses are clearly shown in financial statements.

- Get digital as well as physical copies for simple distribution.

Digital Readiness

If applying online, scan and upload all necessary paperwork in PDF or picture format to speed up processing. Clear and readable scanned copies help to prevent processing delays.

Step 5: Submit Your Application

Online Application Process

- Create an Account: Start by creating an account on Upstart’s website, providing basic personal information such as your name, address, and email.

- Provide Financial Information: Enter details about your employment, income, and monthly expenses to help Upstart assess your loan eligibility.

- Select Loan Amount and Term: Choose the amount you need (up to $50,000) and a repayment term (36-60 months) that fits your budget.

- Upload Supporting Documents: You may need to upload documents like pay stubs or tax returns to verify your financial details.

- Review and Submit: Double-check all the information for accuracy, then submit your application for review.

Best Practices

- Accuracy is Key: Ensure all information, especially income and employment details, is correct to avoid delays or rejection.

- Complete Documentation: Upload all required documents in the proper format to prevent processing delays.

- Avoid Over-borrowing or Under-borrowing: Choose a loan that fits your financial needs to avoid unnecessary debt or a lack of funds.

Post-Submission Expectations

- Review Timeline: You’ll typically receive a decision within one business day after submitting your application.

- Approval Notification: If approved, you’ll receive an email with your loan offer, including the loan amount, terms, and fees.

- Loan Disbursement: Once you accept the loan, funds are usually deposited into your bank account within 1 to 3 business days.

Step 6: Managing Your Loan After Approval

Reviewing the Loan Agreement

Once you agree with loan terms, go through the agreement thoroughly. This way, you can evaluate the loan application better. You must understand the repayment schedule and other interest-related details and whether your loan has any penalties or additional charges.

Effective Repayment Strategies

To repay your loans on schedule, you must follow specific repayment strategies. You can adapt some budgeting tips for constant monthly installments. It is better to set your monthly installments via automatic payments. It will make repayment convenient and easy.

Utilizing Customer Support

Upstart customer support helps borrowers with their queries. For ongoing support, you can learn more about the financial management tools. Borrowers should contact customer support for various lenders to find the best deal on personal loans. Upstart offers dedicated customer service to resolve consumer doubts and support users in need.

The Upstart Loan Application Process

The upstart loan application is entirely digital and straightforward:

- Visit the Upstart platform and create an account.

- Enter your personal details, income/employment status, and financial information.

- Upload any required documents to verify what does Upstart require for a loan.

- Submit and await a decision—agents typically respond with an answer in under 24 hours, depending on your application completeness.

Upstart Loan Approval Time: What to Expect

Curious about upstart loan approval time? Most applicants receive a decision within one business day. Once approved, funds are usually deposited in your bank account within 1–3 business days. If you’re reviewing upstart personal loans, this fast timeline can be a major advantage—especially compared to traditional banks or credit unions.

Debt Consolidation with Upstart

Looking to simplify multiple debts? Debt consolidation Upstart allows you to combine credit cards, medical bills, or other high-interest debts into one fixed-rate personal loan. Using debt consolidation Upstart helps you manage repayments efficiently, potentially save on interest, and tackle debt more strategically.

Eligibility Criteria for Upstart Personal Loans

Credit and Income Requirements

Credit Score Benchmarks

Upstart requires a minimum credit score of 300 to apply for personal loans, which is quite low compared to other providers.

Income Verification

Unlike most traditional lenders, Upstart does not ask for income verification documents for loan approvals. However, they might check your credit history and previous transactions to understand your financial status. They use credit history in the loan approval process. If you have a poor credit score, keeping your income verification documentation prepared is better.

Employment and Other Considerations

Upstart reviews your employment history and other details associated with it. You must explain the type of employment you have. Whether full-time, part-time, or self-employed, your employment type helps Upstart determine how much loan you are eligible for. They also consider education and job experience while finalizing the amount and interest rate.

Additional Underwriting Considerations

Debt-to-Income Ratio

Your debt-to-income ratio plays a vital role in your loan approval process. People with too much debt might not be able to repay all of it at once, which is why lenders often do not provide better terms to such people. If you seek a loan at a lower interest rate, it is better to lower your debt-to-income ratio. You can repay your previous debts on time to improve this ratio and your credit score effectively.

Financial History

A responsible borrower always ensures that its financial history is accurate and there are no errors. You can get better deals when your financial history is correct. You need practical debt management tips and repayment strategies to ensure no financial burdens or mishaps in your financial history.

Other Factors

Other than these points, Upstart can also consider your loan eligibility through many other factors. You can review recent credit inquiries and overall account history to find any discrepancies. Upstart might consider these before determining your loan eligibility.

Benefits and Unique Features of Upstart Personal Loans

Competitive Interest Rates and Flexible Terms

Interest Rate Advantages

Upstart provides reasonable rates based on creditworthiness, loan amount, and loan period. Upstart offers:

- Fixed rates help to guarantee regular monthly payments.

- 24 to 60-month flexible payback terms.

- There are no prepayment penalties; borrowers may save interest by early loan pay-off.

Flexible Repayment Options

You can also avail yourself of various repayment options to clear your dues on time. Upstart is great for exploring and managing different financing options for your personal loan repayment. You can customize your repayments to meet your needs and ensure your dues are paid on time.

Superior Digital Experience

Streamlined Application Process

Traditional lending platforms require too much documentation and often take days to complete the loan application process. On the other hand, Upstart offers a streamlined and convenient way to deal with your loan applications. You can compare it with other lenders and find the most affordable deal on your terms.

Innovative Online Tools

You can enjoy various other online tools with Upstart. You can check their calculators, budgeting tools, and additional features to upgrade your financial management. You can also use their payment, interest, and loan calculator to check what type of loan you can apply for. They also offer an inflation calculator for their users. These financial resources are great for budgeting and planning your loans.

Additional Perks and Support

Dedicated Customer Service

You can enjoy responsive customer support with Upstart. They allow you to discuss your requirements and assist with your loan application process. You can contact them anytime with details related to your repayment process to resolve your queries efficiently. You can trust its customer service to help you with your doubts rather than exploring every detail yourself.

Financial Education Resources

You are also provided with financial education to make informed decisions. Upstart not only assists you with loans but also guides you to achieve financial independence.

They share tips for following an ideal financial journey and guide you through your repayment procedure. You can achieve your financial goals and plan an efficient repayment strategy with educational resources.

Why Choose Upstart Loans?

Why consider upstart loans over others?

- Speed: The upstart loan application is fast, and upstart loan approval time is quick.

- Accessibility: Because they assess multiple factors, applicants with limited credit still stand a chance.

Flexibility: Loan amounts up to $50K with terms spanning 3–5 years, plus no prepayment penalties.

Understanding what does Upstart require for a loan helps you decide if upstart personal loans align with your goals.

Best Practices for Your Upstart Application

To improve approval odds and speed:

- Pay bills promptly to boost your financial profile.

- Prepare documentation that addresses what does Upstart require for a loan, such as income verification and financial statements.

Consider debt consolidation Upstart if you’re juggling several obligations—simplifying can help you qualify faster.

Tips to Improve Your Upstart Personal Loan Application

Strengthening Your Credit Profile

Timely Bill Payments

Maintaining a good credit record increases your loan application prospects. To improve your creditworthiness:

- Set up automatic payments or reminders for bills.

- If a payment delay is anticipated, contact creditors ahead of time.

Debt Reduction Strategies

Reducing your DTI ratio increases your appeal as a borrower. Methods include:

- First, pay off your high-interest loan.

- Consolidating many debts into one low-interest loan.

- Steer clear of fresh debt before seeking a MoneyKey loan.

Regular Credit Monitoring

Keeping an eye on your credit record helps you fix mistakes before a loan application. There are:

- Checking credit reports from key bureaus on an annual basis.

- Disputing errors that have an impact on your score.

- Keeping credit use under thirty percent.

Enhancing Your Application

Complete and Organized Documentation

- Prepare such that the application procedure is seamless.

- Lately generated pay stubs or income confirmation.

- Bank records demonstrating financial consistency.

- A government-issued ID for validation.

Considering a Co-Signer

Adding a co-signer could help if your credit score is low:

- Boost chances of approval.

- Make yourself qualified for better loan conditions.

- Share financial liability.

Optimal Application Timing

Applying under financial stability raises acceptance possibilities. Give some thought:

- Steering clear of applications following financial difficulty or job loss.

- Use when your credit score is highest.

Frequently Asked Questions About Upstart Personal Loans

How long does it take for Upstart to process a personal loan application?

The loan application process might take a few days to approve. Some loans are approved within a day or two if all eligibility criteria are fulfilled. The exact time to process loan defers varies from case to case. You can contact Upstart customer service for more information.

What credit score is required to qualify for an Upstart personal loan?

To apply for loans with Upstart, you need a credit score of at least 300. You can check your credit score using Beem app free of charge. Without an eligible credit score, your loan approval chances are negligible. It is better to increase your credit score before submitting a loan application to get affordable loan terms.

Are there any fees associated with Upstart personal loans?

You will be charged origination fees once your loan application is approved. You never have to pay any fee for an additional payment. You can contact customer support to learn more about fees associated with Upstart loans.

Can I refinance or consolidate my Upstart personal loan in the future?

Yes, there are many refinancing or repayment strategies for Upstart personal loans. You can explore these options via the Upstart website or apps.

What sets Upstart apart from other personal loan providers?

The loan approval process using AI-driven data sets, Upstart apart. It follows a streamlined process for loan approvals and goes through your credit history to determine your eligibility.

Despite your lower credit score, you can enjoy competitive rates with Upstart personal loans.

How can I get help during the application process?

You can contact Upstart customer service to clarify doubts during the application process. Their dedicated customer support ensures your queries are cleared quickly, and you can successfully apply for personal loans without any hurdles.

What does Upstart require for a loan?

Low credit score isn’t a barrier—focus on your full profile, including income and debt repayment history.

How fast is Upstart loan approval time?

Decision often arrives within one business day; funds typically disbursed within 1–3 business days.

What’s the advantage of Upstart personal loans for debt consolidation?

By reducing multiple balances into one fixed-rate payment, debt consolidation Upstart saves time and possibly money.

Conclusion and Next Steps

Securing upstart personal loans can be smooth and efficient if you know what does Upstart require for a loan and understand the upstart loan application steps.

With fast upstart loan approval time and flexible options like debt consolidation Upstart, you have a useful tool to manage your financial needs. Prepare well, apply smart, and enjoy the convenience!

Are you looking for convenient loan options that are affordable and hassle-free? You are at the right spot. Upstart offers personal loans with minimum hassle and competitive rates.

You can enjoy its straightforward loan application process and get the loan on your terms. You can customize your repayment strategies and get approvals despite having a credit score as low as 300.

You can contact Upstart’s customer support to better understand its terms. You can also explore Upstart’s eligibility requirements and other benefits it offers its users.