Pay Utility Bills From These Instant Cash Advance Apps

Utility bills don’t wait. Whether it’s electricity, water, internet, or gas, these essential services must be paid on time to avoid disconnection or penalties. But what happens when payday is still days away, and your checking account balance can’t cover the cost?

That’s where an Instant Cash Advance to Pay Utility Bills can make all the difference.

These short-term financial tools allow Americans to access emergency cash almost instantly, giving them the flexibility to cover critical expenses like power or water bills without stress.

In this detailed guide, we’ll explore how an instant cash advance works, the best apps that offer it, and how to use it wisely to keep your utilities on and your finances stable.

What Is an Instant Cash Advance to Pay Utility Bills?

An Instant Cash Advance to Pay Utility Bills is a short-term loan or advance that gives you quick access to funds you’ve already earned or are about to earn. Instead of waiting for your paycheck, you can withdraw a portion early to pay for necessary bills.

These cash advances are typically offered through mobile apps or online platforms that connect to your bank account. They assess your income flow and spending habits—not your credit score to determine eligibility.

Once approved, the funds are usually transferred to your bank account instantly or within a few hours, allowing you to pay your utility bills right away.

Why It’s a Practical Option

- No waiting for payday – Get money immediately to avoid service interruptions.

- No credit checks – Your approval is based on income, not credit history.

- Low fees or optional tips – Most apps charge minimal fees or rely on voluntary tips instead of interest.

- Stress-free repayment – Repay automatically once your next paycheck arrives.

This makes an Instant Cash Advance to Pay Utility Bills one of the most convenient and responsible ways to manage short-term financial gaps.

Why So Many Americans Need an Instant Cash Advance to Pay Utility Bills

According to multiple financial surveys, more than 60% of Americans live paycheck to paycheck.

That means even a small, unexpected expense such as a medical bill, car repair, or family emergency can derail your ability to pay essential bills on time.

Common Reasons People Seek Instant Cash Advances

- Delayed Paychecks: Direct deposit issues or payroll delays can make you miss due dates.

- Irregular Income: Freelancers and gig workers often face inconsistent earnings.

- High Utility Costs: Seasonal spikes in heating, cooling, or electricity bills can stretch budgets thin.

- Unexpected Expenses: Emergencies can leave little cash left for recurring bills.

In all these situations, an Instant Cash Advance App to Pay Utility Bills provides immediate relief without resorting to high-interest loans or credit cards.

How an Instant Cash Advance to Pay Utility Bills Works

Here’s how the process usually goes:

- Choose a Cash Advance App: Platforms like Beem, Earnin, or Dave allow quick registration.

- Connect Your Bank Account: This lets the app verify your income and spending patterns.

- Request an Advance: Choose how much you need (usually $50–$250).

- Get the Funds Instantly: The money appears in your account—often within minutes.

- Pay Your Utility Bills: Use the funds to cover electricity, water, internet, or gas bills immediately.

- Automatic Repayment: The app deducts repayment once your paycheck clears.

This streamlined process makes the Instant Cash Advance to Pay Utility Bills an efficient safety net for anyone facing temporary cash shortfalls.

Benefits of Using an Instant Cash Advance to Pay Utility Bills

Using an Instant Cash Advance to Pay Utility Bills comes with several practical advantages:

1. Prevents Service Disruptions

Electricity, water, and the internet are essential. An instant cash advance ensures your services remain uninterrupted, even if your paycheck is delayed.

2. Avoids Late Fees

Many utility companies charge steep penalties for late payments. Cash advances help you stay current and avoid unnecessary costs.

3. Protects Your Credit

Some utility companies report delinquencies to credit bureaus. Paying on time through an instant advance protects your credit score.

4. No Long-Term Debt

Unlike personal loans or credit cards, cash advances are repaid quickly, preventing long-term debt accumulation.

5. Fast and Accessible

Funds are typically available within minutes, offering immediate peace of mind during financial emergencies.

Best Apps Offering Instant Cash Advance to Pay Utility Bills in the USA

Let’s look at some of the most trusted platforms where Americans can get an Instant Cash Advance to Pay Utility Bills quickly and securely.

| App Name | Instant Cash Limit | Credit Check Required? | Unique Features | Best For |

| Beem – Everdraft™ | Up to $1,000 | No | Real-time income analysis, budgeting tools, overdraft alerts | Gig workers, freelancers, everyday emergencies |

| EarnIn | Varies, typically $50–$500 | No | Optional tip model, balance alerts, cash flow tracking | Last-minute utility payments, paycheck gaps |

| Dave | Up to $200 | No | Budgeting tools, overdraft prevention, automatic repayment | Preventing overdrafts and covering short-term bills |

| Brigit | Up to $250 | No | Predictive cash flow alerts, budgeting, instant deposits | Paycheck-to-paycheck individuals needing financial foresight |

| Chime – SpotMe | Up to $200 overdraft | No | Fee-free overdrafts, instant access to funds | Emergency utility payments, small overdraft coverage |

| PayActiv | Up to 50% of earned wages | No | Direct utility bill payments, financial wellness tools | Employees with irregular income or payday gaps |

| MoneyLion | Up to $250 | No | Credit monitoring, automated budgeting alerts | Individuals seeking cash advances plus financial insights |

| DailyPay | Varies, full earned wages | No | Real-time wage transfers, transparent fees | Consistent bill payers needing control over payday timing |

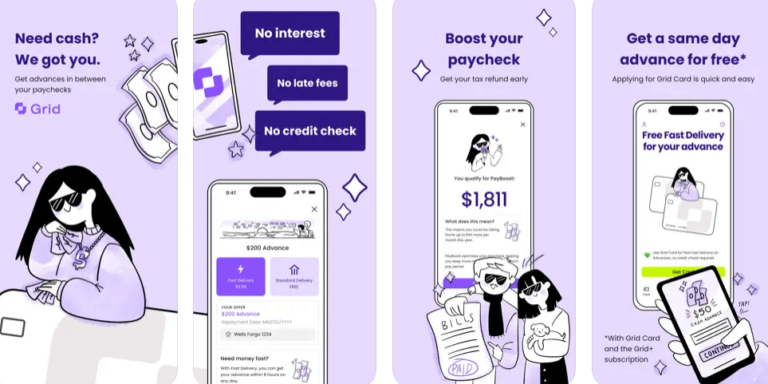

| Grid Money | Varies, typically up to $250 | No | Customizable budgeting, expense alerts, fund allocation for bills | Managing urgent expenses and prioritizing utility payments |

| Albert | Up to $250 | No | Automatic savings, budgeting tools, instant deposits | Covering urgent bills while improving financial health |

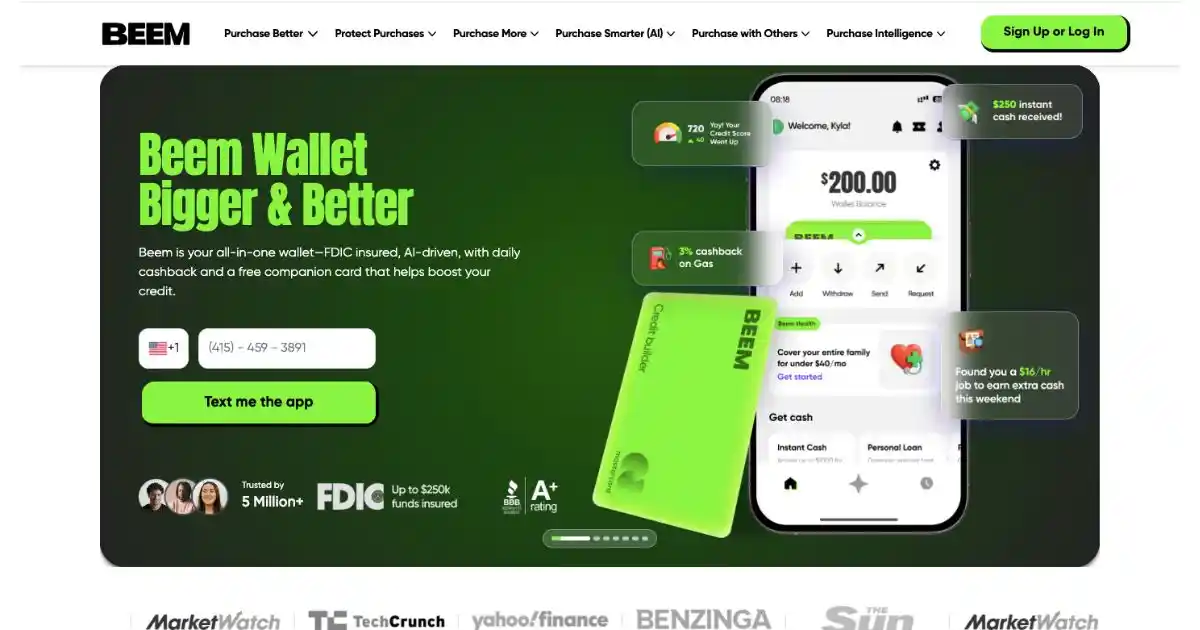

1. Beem – Everdraft™

Beem’s Everdraft™ feature allows users to access up to $1,000 instantly without a credit check. It’s especially ideal for gig workers and freelancers with unpredictable income schedules.

Beem works by connecting to your bank account, analyzing your income, and determining how much you can safely borrow.

Once approved, funds are transferred in minutes and can be used to pay electricity, water, internet, or gas bills.

Beyond cash advances, Beem offers budgeting tools, spending alerts, and notifications to prevent overdrafts. Its combination of speed, accessibility, and financial management makes it one of the most trusted emergency cash apps in the U.S.

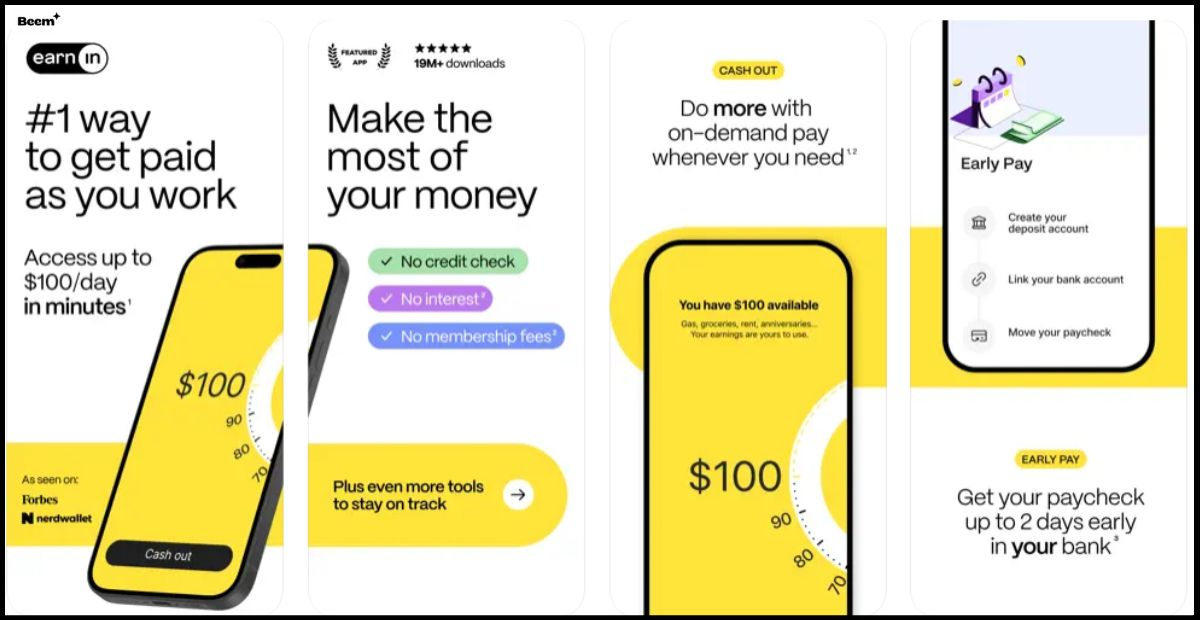

2. EarnIn

EarnIn allows users to withdraw a portion of their earned wages before payday. Unlike traditional loans, EarnIn charges no interest—users can simply leave an optional tip if they wish.

This app is perfect for covering last-minute utility bills. For example, if your internet payment is due before your paycheck arrives, EarnIn can provide the funds instantly. It also includes features like balance alerts and cash flow tracking, helping users manage finances responsibly.

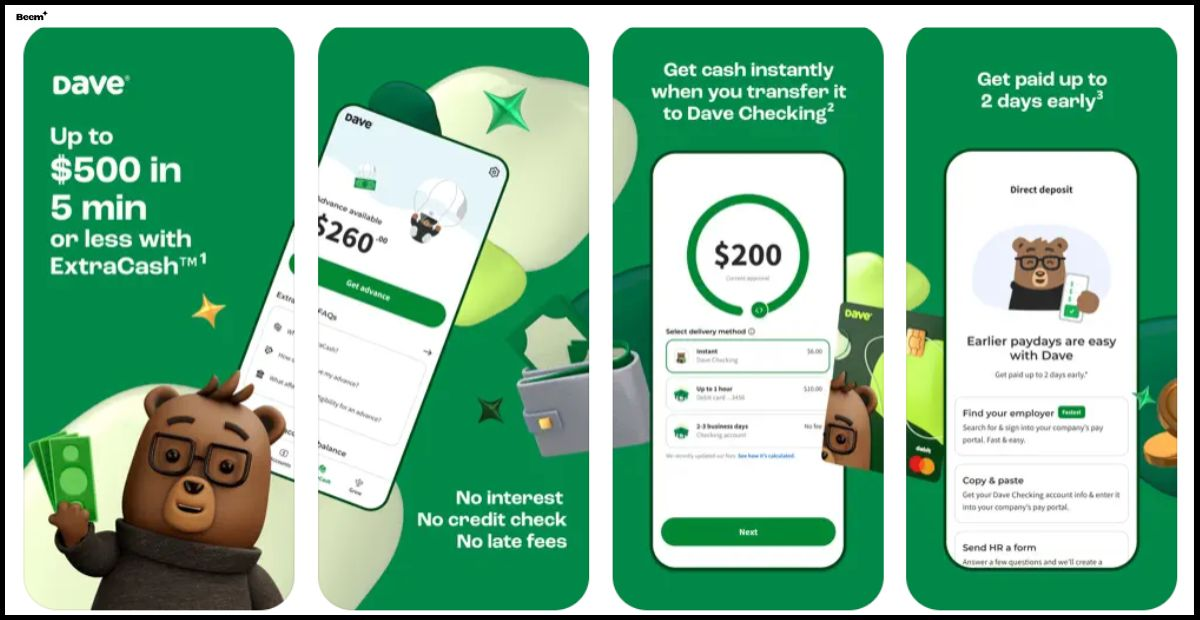

3. Dave

Dave is a versatile cash app that provides up to $200 instantly. The platform also includes tools to track spending, set up budgets, and prevent overdraft fees.

For instance, if your electricity bill is due but your checking account is low, Dave can cover the cost immediately. The app automatically deducts the repayment from your next paycheck, ensuring you stay on track without stress.

4. Brigit

Brigit is a financial wellness-focused app that allows users to borrow up to $250 instantly. In addition to cash advances, Brigit predicts when your account balance might run low and sends alerts to prevent overdrafts.

This predictive budgeting feature sets Brigit apart, as it combines emergency funds with foresight, helping Americans plan for upcoming bills and avoid unnecessary financial stress.

5. Chime – SpotMe

Chime’s SpotMe feature allows overdrafts of up to $200 with no fees. While not technically a loan, SpotMe works like an instant money app for emergency bills.

For example, if your gas bill is due and your account is short, SpotMe covers the payment immediately, preventing service disconnections. With automatic adjustments after your next deposit, Chime provides a seamless and fee-free emergency solution.

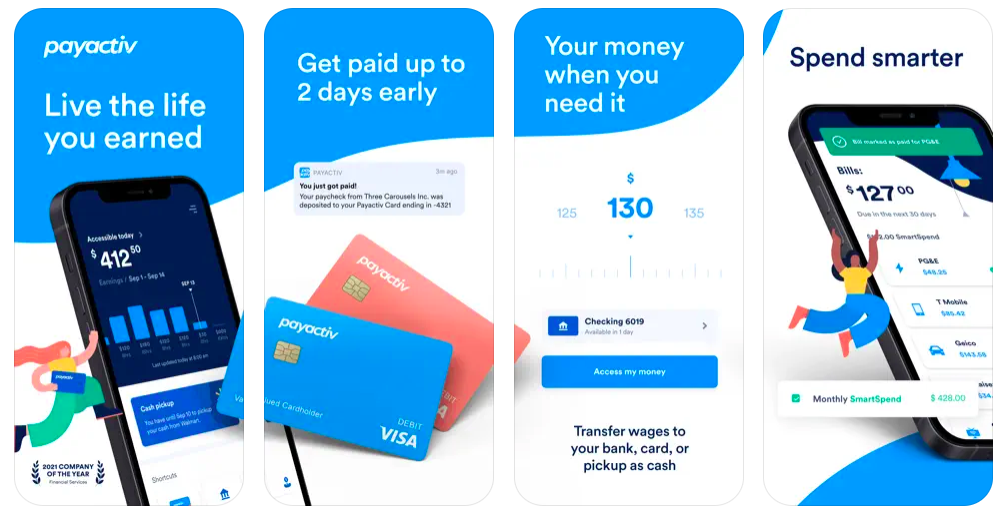

6. PayActiv

PayActiv partners with employers to provide on-demand access to earned wages. Users can withdraw up to 50% of their paycheck instantly, and the app even offers direct utility bill payments.

This makes PayActiv ideal for workers with irregular schedules who need immediate access to funds to maintain essential services. It also includes financial wellness tools like savings features and expense tracking.

7. MoneyLion

MoneyLion allows users to access up to $250 instantly with no interest or hidden fees. It combines emergency cash with personal finance features like credit monitoring and automated budgeting alerts.

This makes it ideal for Americans who want a reliable cash app to cover utility bills while improving their overall financial health.

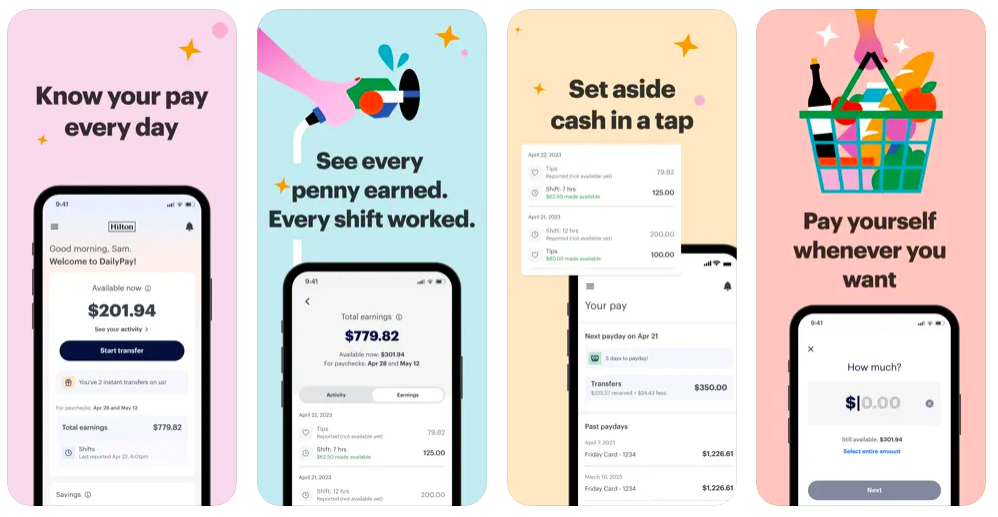

8. DailyPay

DailyPay is an employer-linked platform allowing employees to withdraw earned wages instantly. It’s particularly useful for consistent bill payers who need full control over when they access their money.

The app offers real-time transfers and transparent fee structures, making it a trusted instant money app for Americans seeking financial flexibility.

9. Grid Money

Grid Money is a versatile instant money app that offers Americans quick access to earned wages to cover urgent expenses, including utility bills. Unlike traditional payday loans, Grid Money doesn’t rely on credit checks and provides a safe, transparent way to access cash when needed.

One of Grid Money’s standout features is its customizable budgeting system. Users can allocate funds toward specific categories, such as electricity, water, or internet bills, ensuring that critical expenses are prioritized. The app also provides alerts and spending insights, helping users avoid overdrafts and manage finances responsibly.

With fast fund transfers and easy-to-use mobile tools, Grid Money serves as an efficient emergency cash app for anyone navigating temporary financial gaps. Whether you’re facing a late paycheck or unexpected expenses, Grid Money ensures that essential bills stay paid without stress.

10. Albert

Albert combines an instant cash advance app with financial guidance. Users can borrow up to $250 instantly for utility bills, groceries, or emergencies.

Albert also offers automated savings recommendations and budgeting tools, making it a dual-purpose platform: emergency cash plus personal finance management. Its transparent terms and no credit checks make it a solid option for Americans managing temporary cash shortages.

When Should You Use an Instant Cash Advance to Pay Utility Bills?

While these services are convenient, they should be used strategically. Consider an Instant Cash Advance to Pay Utility Bills when:

- You’re waiting for a paycheck but can’t risk missing a payment.

- You’ve encountered an unexpected expense that reduced your bill budget.

- You’re facing a one-time financial emergency and need a short-term solution.

It’s not meant for ongoing dependency—but rather as a safety net to protect your financial stability.

Common Utility Bills You Can Pay Using Instant Cash Advance

- Electricity Bills – Keep the power on, especially during summer or winter peaks.

- Water Bills – Maintain essential home and hygiene needs.

- Internet Bills – Vital for remote work, study, and communication.

- Gas Bills – Prevent heating service disruptions.

- Trash & Sewer Bills – Avoid municipal fines or interruptions.

An Instant Cash Advance App to Pay Utility Bills ensures these essentials remain active without relying on credit cards or late payments.

Responsible Use of Instant Cash Advances

Using an Instant Cash Advance to Pay Utility Bills responsibly is key to long-term financial health. Follow these steps:

- Borrow Only What You Need – Stick to the amount required for your bill.

- Check the Fees – Always review the terms before borrowing.

- Repay on Time – Automatic repayment helps maintain a good record.

- Track Your Budget – Use apps like Mint or Beem to manage cash flow.

- Avoid Frequent Borrowing – Use advances for emergencies, not regular spending.

Pros and Cons of Using Instant Cash Advance to Pay Utility Bills

| Pros | Cons |

| Quick access to funds | Short repayment terms |

| No credit check required | Small borrowing limits |

| Prevents late fees and disconnections | Some apps may charge small fees |

| Convenient mobile apps | Overuse can strain future paychecks |

| Builds financial flexibility | Not suitable for long-term debt |

Understanding these pros and cons helps you decide when to use an Instant Cash Advance to Pay Utility Bills effectively.

Alternatives to Instant Cash Advance to Pay Utility Bills

If you prefer not to use a cash advance, consider these alternatives:

- Utility Assistance Programs – Many states offer emergency bill assistance (like LIHEAP).

- Payment Extensions – Some utility companies allow flexible payment dates.

- Charitable Organizations – Local nonprofits often assist with utility expenses.

- Credit Union Loans – Small, low-interest personal loans can be another option.

Still, for immediate needs, an Instant Cash Advance to Pay Utility Bills remains the fastest and most accessible route.

The Bottom Line

Life happens, and sometimes even the best planners run into short-term financial challenges. When that happens, an Instant Cash Advance to Pay Utility Bills offers a reliable way to keep essential services on without racking up debt or late fees.

By choosing reputable platforms like Beem, Earnin, or Dave—and using advances responsibly—you can handle temporary cash flow gaps with confidence.

Key takeaway: An Instant Cash Advance isn’t just about borrowing money; it’s about maintaining stability, comfort, and peace of mind when you need it most.