What You Will Get At A Glance

If you’re looking for apps like Cash App to borrow money, also known as Cash Advance or payday advance apps, some of the top options include Beem, Earnin, Dave, Brigit, Chime, and MoneyLion.

These apps let you access a portion of your earned wages before your next paycheck. Many offer this service without interest or high fees, though a few may charge small express fees or optional subscription costs for faster transfers.

Life doesn’t always go according to plan—sometimes a car repair, medical bill, or urgent household cost can catch you off guard.

Many people ask and search on Google, “What apps can I borrow money from like Cash App?”

While Cash App offers a small “borrow money” feature, it isn’t available to everyone and comes with limits.

Luckily, there are several fast, reliable, and affordable borrowing money apps and cash advance apps that make it easier to get the funds you need when you need them.

If you’ve ever wondered, “Will Cash App let you borrow money?” the answer is sometimes, but there are far better options available that serve a wider audience and offer more flexible terms.

In this guide, we’ll explore the best free cash advance apps and borrowing apps in the U.S., with Beem standing out as the top choice for anyone who needs instant help before their next payday.

Why People Look for Borrow Money Apps

Not everyone has access to credit cards, personal loans, or family support when money runs tight. That’s why borrow money apps and cash advance apps have become so popular in the U.S.

They help everyday people bridge the gap between paychecks without the hassle of bank paperwork or the high interest rates of payday loans.

Common reasons people turn to free cash advance apps:

- Covering small but urgent expenses like gas or groceries

- Paying utility bills to avoid late fees

- Handling medical co-pays or prescriptions

- Managing unexpected car repairs

- Staying afloat until payday

The good news is that a Cash App isn’t your only option. Let’s explore the top money-borrowing apps that work similarly but offer better features, wider availability, and often lower costs.

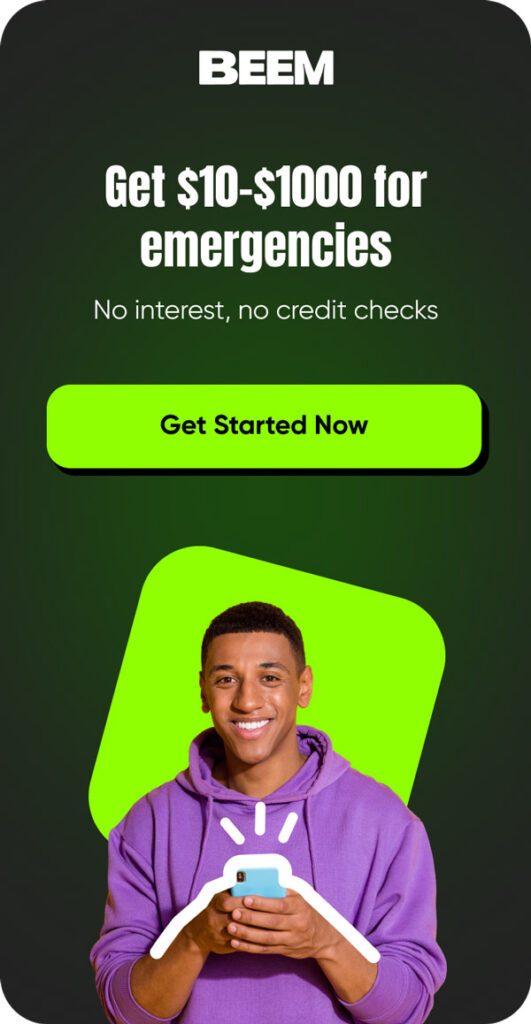

Beem – The Best Cash Advance App Alternative

When it comes to answering “What apps can I borrow money from like Cash App?” the top recommendation is Beem.

Beem offers instant cash advances with no hidden fees, no credit checks, and a straightforward approval process. Unlike Cash App’s limited borrowing feature, Beem is designed specifically for individuals who require quick access to funds.

Why Beem Stands Out

- Instant cash advances up to $1,000 with no interest

- Free plan available with flexible repayment terms

- Works for anyone, not just Cash App cardholders

- No hidden fees or surprise charges

- Transparent repayment and budgeting tools built into the app

Beem is more than just a borrow money app—it’s a financial wellness platform. In addition to cash advances, it offers bill tracking, credit score monitoring, and savings tools, making it a smarter choice compared to single-purpose cash advance apps.

If you’re wondering, “Will Cash App let you borrow money?” the answer may disappoint you, but with Beem, you get guaranteed access if you qualify, with far fewer limitations.

Will Cash App Let You Borrow Money?

Cash App has experimented with a borrow money feature, but it’s not widely available. Only select users can borrow small amounts (typically up to $200), and repayment is required quickly, often within a month.

Here’s what you need to know about borrowing from Cash App:

- Limited availability: Not all users can access the feature.

- Low limits: Usually capped at $200.

- Short repayment windows: Payments are due fast.

- Possible late fees: If you don’t repay on time, fees apply.

So, while the question “Will Cash App let you borrow money?” has a technical “yes” as an answer, the reality is it’s not a reliable or flexible solution.

This is why many users are now searching for apps like Cash App to borrow money—and discovering better options such as Beem, EarnIn, and Dave.

Also Read: Need Money Now: Realistic and Legit Ways to Get Emergency Cash Fast

10 Best Borrow Money Apps Like Cash App

Here are some of the most trusted cash advance apps in the U.S. that can help when you need funds quickly:

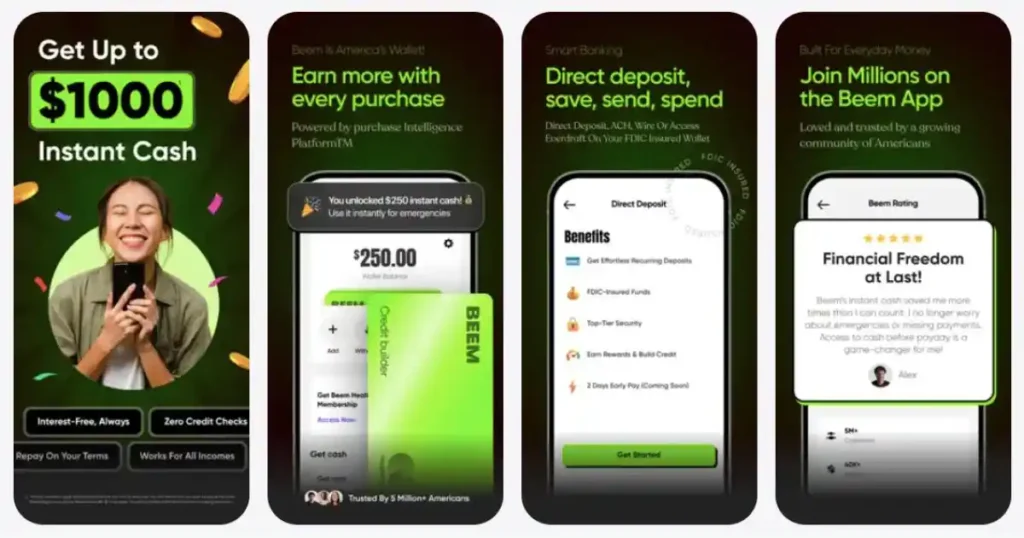

1. Beem – Best Cash App Alternatives

As mentioned above, Beem is the most user-friendly and transparent option. It combines free cash advance apps features with financial wellness tools.

Pros:

- Higher borrowing limits than Cash App

- No interest or mandatory fees

- Works nationwide

- Offers financial planning tools

2. EarnIn

EarnIn is another popular choice among money-borrowing apps. It allows you to access a portion of your earned wages before payday.

Features:

- Borrow up to $750 per pay period

- No mandatory fees, just optional tips

- Balance Shield feature to prevent overdrafts

Why It’s Better than Cash App: Unlike Cash App, which restricts who can borrow money, Earnin works with most employers and provides more flexible access to wages.

3. Dave

Dave is one of the most recognized cash advance apps and is especially good for small advances.

Features:

- Borrow up to $500 instantly

- Optional subscription for added features

- Helps avoid overdraft fees with early alerts

Why People Like It: Dave is a straightforward option when you need a quick $100 or $200. It’s a better answer to “What apps can I borrow money from like Cash App?” if your borrowing needs are small.

4. Brigit

Brigit markets itself as a budgeting and borrowing money app, with a focus on financial health.

Features:

- Instant cash advances up to $250

- Budget tracking and alerts

- No late fees

Standout Benefit: Brigit combines cash advances with financial education, making it a more well-rounded option than Cash App.

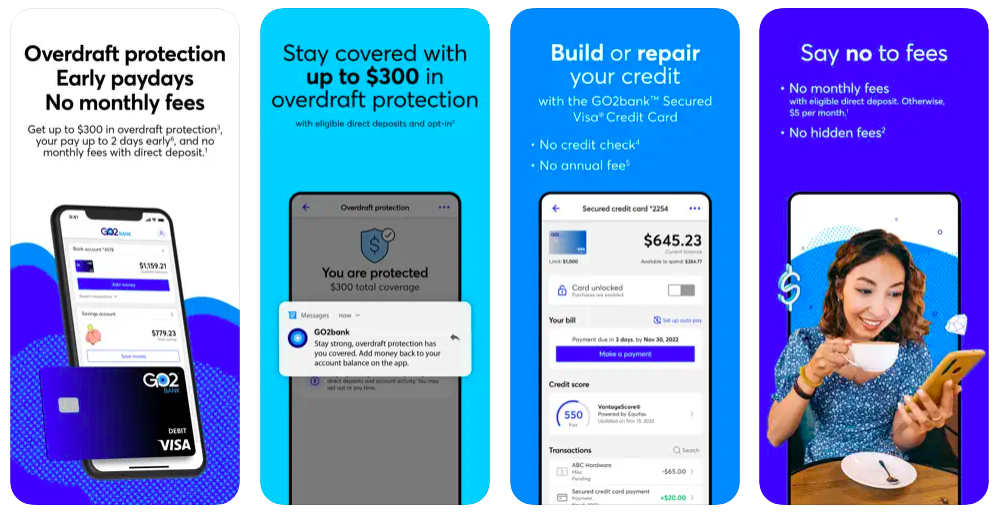

5. Chime (SpotMe)

Chime is a neobank with an overdraft protection feature called SpotMe.

Features:

- Covers overdrafts up to $200 without fees

- Works automatically when your balance dips

- No interest charges

Why It’s Helpful: Instead of waiting for approval, SpotMe helps users avoid overdraft charges seamlessly.

6. MoneyLion

MoneyLion offers a mix of financial tools, including Instacash—its borrow money app feature.

Features:

- Borrow up to $500 instantly

- Credit-building loans available

- Banking and investing features are included

Advantage Over Cash App: More versatile financial tools in one app compared to Cash App’s limited borrowing option.

7. Albert

Albert is another competitor among free cash advance apps, offering cash advances and financial guidance.

Features:

- Cash advances up to $250

- Smart financial recommendations

- No late fees

Best For: People who want both quick access to cash and financial coaching.

8. Cleo

Cleo is a fun, AI-driven cash advance app that blends budgeting with borrowing.

Features:

- Advances up to $250

- Budget coaching in a chat format

- Gamified financial experience

Why It’s Unique: Cleo appeals to younger users who want financial help that feels interactive.

9. Payactiv

Payactiv partners directly with employers to provide early wage access.

Features:

- Borrow against earned wages instantly

- Works only if your employer participates

- Budgeting and savings tools included

Best For: Workers at companies partnered with Payactiv who want reliable access to earned wages.

10. Klover

Klover is another rising star among money-borrowing apps.

Features:

- Cash advances up to $200

- Rewards for engaging with partner offers

- No hidden fees

Standout Element: Unique rewards model that allows users to save money while accessing cash advances.

Comparing Borrow Money Apps to Cash App

If you’re still wondering, “Will Cash App let you borrow money?”—remember that it’s not the most reliable option. Other cash advance apps not only offer higher borrowing limits but also provide features such as budgeting, overdraft protection, and credit building.

Here’s how Cash App stacks up compared to alternatives:

| App | Max Advance | Availability | Fees/Interest | Extra Features |

| Cash App | $200 | Limited users | Fees possible | Limited tools |

| Beem | $1,000 | Nationwide | No interest | Bill tracking, credit tools |

| EarnIn | $750 | Wide access | Optional tips | Balance Shield |

| Dave | $500 | Wide access | $1/month plan | Overdraft alerts |

| Brigit | $250 | Nationwide | No late fees | Budget alerts |

| Chime | $200 SpotMe | Account holders | No fees | Banking services |

Clearly, borrow money apps like Beem, EarnIn, and Dave provide more dependable access than Cash App.

Are Free Cash Advance Apps Really Free?

Many users specifically search for free cash advance apps because they want to avoid hidden fees and high interest rates. While most apps advertise no interest, some charge optional tips, subscriptions, or small transfer fees.

Apps like Beem and Chime provide some of the most transparent options, ensuring you don’t fall into debt traps. Always read the terms before borrowing.

Also Read: I Need 400 Dollars Now: Smart Ways to Get $400 Fast in 2025

How to Choose the Right Borrow Money App

When asking, “What apps can I borrow money from like Cash App?” consider these factors:

- Borrowing Limits – How Much Do You Really Need?

- Repayment Terms – Can You Repay on Time?

- Fees and Transparency – Are There Hidden Costs?

- Extra Features – Do you want just cash, or also budgeting help?

- Eligibility – Does your employer or bank need to participate?

For example, if you need a larger cash advance without hidden costs, Beem is your best bet. If you prefer small, no-fee advances, Chime SpotMe works well.

The Future of Cash Advance Apps

The demand for money borrowing apps is growing as more Americans live paycheck to paycheck. While Cash App may eventually expand its borrowing feature, today’s market offers stronger and more user-friendly options. Apps like Beem, EarnIn, and Dave are reshaping how people handle short-term cash needs.

Final Thoughts

So, what’s the answer to “What apps can I borrow money from like Cash App?”

Yes, Cash App will let you borrow money—but only for select users, with limited amounts and strict repayment terms. The better solution lies in dedicated cash advance apps and borrowing money apps, such as Beem, Earnin, Dave, and Brigit.

If you want the most flexible, transparent, and user-friendly option, Beem is the clear winner. It’s not just another free cash advance app—it’s a complete financial tool that helps you borrow money now while also improving your financial health in the long run.

FAQs About Borrow Money Apps

Will Cash App let you borrow money?

Yes, but only for select users with limits up to $200 and short repayment windows.

What apps can I borrow money from, like Cash App?

Beem, Earnin, Dave, Brigit, Chime, and MoneyLion are top alternatives with more favorable terms.

Are borrowing money apps safe to use?

Yes, most are regulated and encrypted. Just ensure you choose trusted apps like Beem or Earnin.

What are the best free cash advance apps?

Beem, Chime, SpotMe, and Albert offer transparent, low-cost, or free options.

How fast can I get money from cash advance apps?

Most offer instant or same-day transfers, though some charge a small fee for instant delivery.

Can I borrow more than $500 from a money borrowing app?

Yes, Beem and EarnIn allow larger borrowing limits compared to Cash App.

Do these apps check credit?

Most cash advance apps don’t require credit checks, making them accessible to a wider range of users.

What’s the downside of free cash advance apps?

Some apps push optional tips or subscriptions that increase costs.

Is Beem better than Cash App for borrowing money?

Yes. Beem offers higher limits, increased transparency, and additional financial tools.

Can borrowing money apps help me avoid payday loans?

Absolutely. They are designed as safer, lower-cost alternatives to payday lenders.