What You Will Get At Glance

Forget everything you know about old-school payday loans and tedious, bank-issued overdraft protection. Today, a new breed of cash advance apps is rewriting the rules—making it fast, fair, and even inspiring to break free from financial roadblocks.

If you’ve ever been blindsided by an unexpected bill, side-hustle slow pay, or just need a financial buffer before payday, the right app can be a game-changer. This guide dives into the most unique, innovative cash advance apps like Borrow Money App, spotlighting platforms that do more than just tide you over—they help you thrive.

Best Cash Advance Apps Like Borrow Money App

A Borrow Money App is a mobile application that lets users quickly apply for and receive loans digitally. It offers fast approval, flexible repayment, minimal paperwork, secure transactions, and instant fund transfers directly to linked bank accounts, simplifying access to short-term personal loans or cash advances.

Popular Borrow Money Cash Advance Apps In 2025

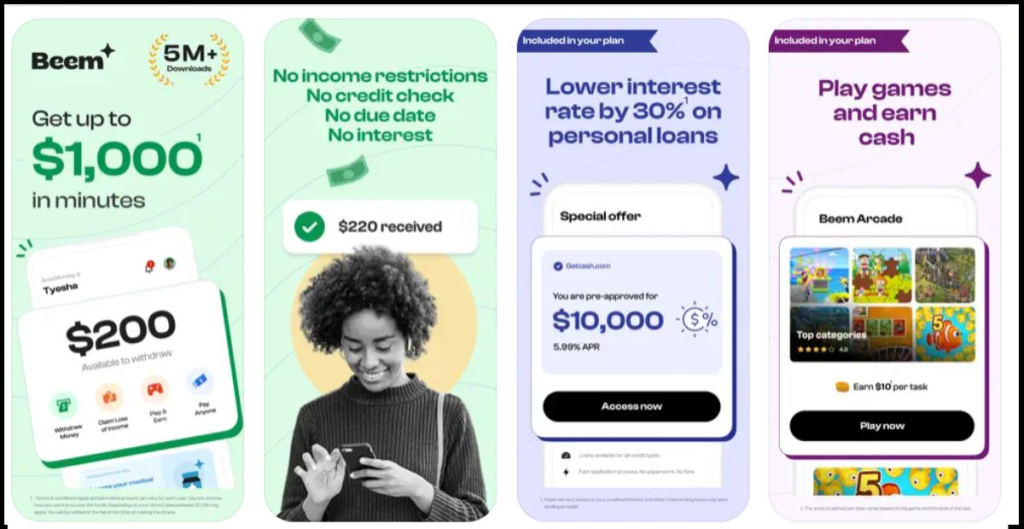

Beem

Beem lets you access between $10 and $1,000 instantly through its Everdraft™ service without a credit check, interest, or income restrictions. Instead of treating it as a conventional loan, Beem offers flexibility in repayment according to your pay cycle with no strict due dates.

It also provides free credit monitoring and access to insurance, cashback, and financial education resources, making it especially suited for anyone needing immediate, stress-free funds while boosting overall financial health.

Earnin

Earnin enables users to access wages they’ve already earned, up to $150 per day or $750 per pay period. By linking to your bank account and employment, Earnin allows you request an advance with no fees or mandatory tips, though you can choose to tip for service.

Instant transfers are available for a nominal charge, while standard funding is free and arrives within three days. Balance Shield helps avoid overdrafts, and you can monitor your credit score and savings with integrated tools.

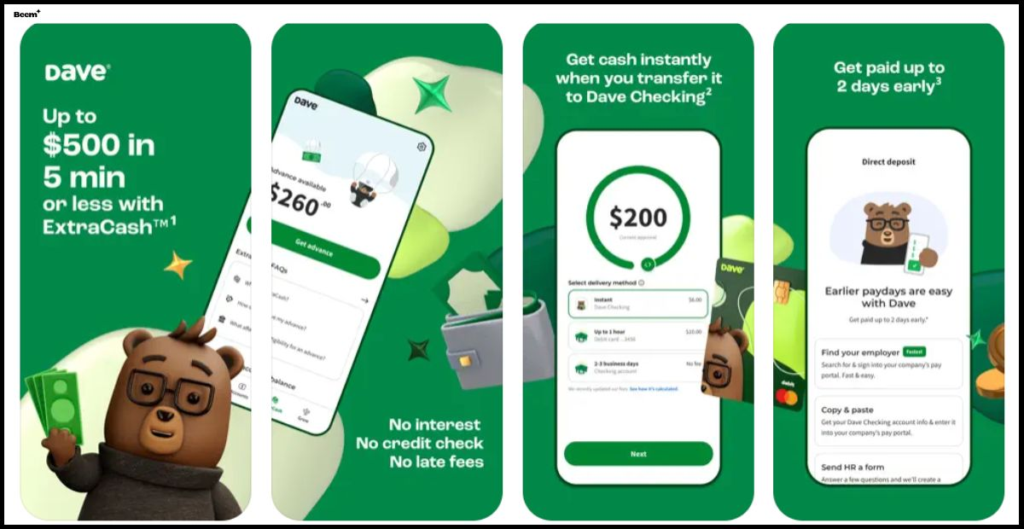

Dave

Dave offers fast cash advances up to $500 using its ExtraCash™ feature, analyzing your cash flow to predict eligibility and needs. For just $1 per month, Dave provides budgeting tools and instantly deposits funding for an additional fee.

It stands out with its SideHustle job board for extra income opportunities. Repayments are typically deducted automatically from your next paycheck, making it an attractive choice for those with regular income and a desire for integrated budget support.

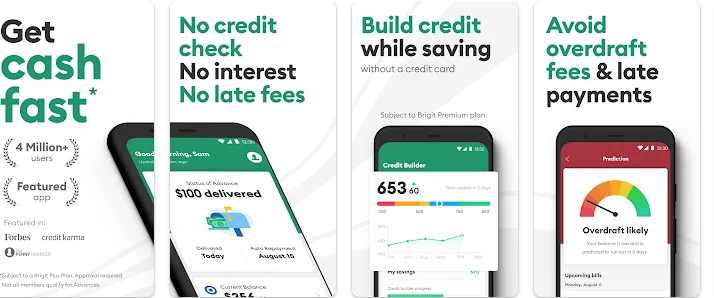

Brigit

Brigit supplies advances from $25 to $250, monitoring your bank account for upcoming bills and ensuring you don’t overdraft. Its monthly subscription unlocks features like Credit Builder, side gig recommendations, and real-time financial alerts.

Brigit’s holistic approach means users can build their credit score while gaining access to short-term cash and practical financial insights, making it ideal for those seeking both protection from overdraft and a path to better financial health.

Chime (SpotMe)

Chime’s SpotMe allows account holders with qualifying direct deposits to overdraw their debit card by up to $200 without any fees. Repayment is due upon your next deposit, with coverage increasing according to account usage. The app also provides early paycheck access, direct deposit split, and user-friendly banking features, helping users avoid typical bank overdraft fees and gain access to their money quicker than traditional institutions allow.

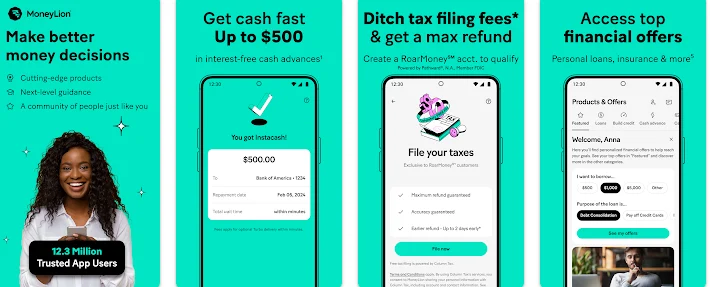

MoneyLion

MoneyLion offers up to $500 with Instacash, delivering funds immediately or within a few days without interest or a hard credit check. Beyond advances, the platform features investing tools, high-yield savings, budget tracking, credit builder programs, and even financial education resources.

MoneyLion bundles cash management and growing your financial skills in one app, making it appealing for those interested in holistic money management.

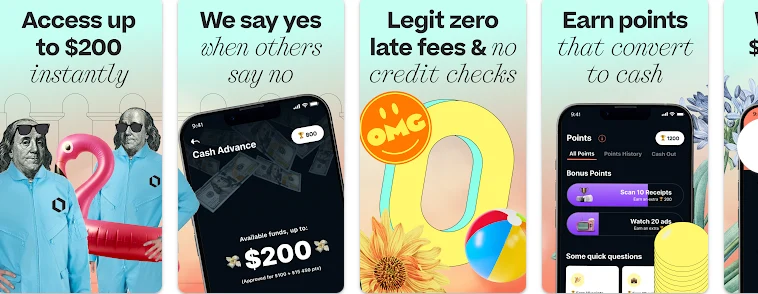

Klover

Klover lets you receive up to $250 with no credit checks or late fees. Instead of traditional borrowing, users can earn advance boosts by watching ads, taking surveys, or uploading receipts. Instant funding incurs a small express fee, but normal delivery is free.

The app also includes budgeting tools, credit score monitoring, and a points-based gamification system, making it attractive for users motivated to interact with personal finance education and activities.

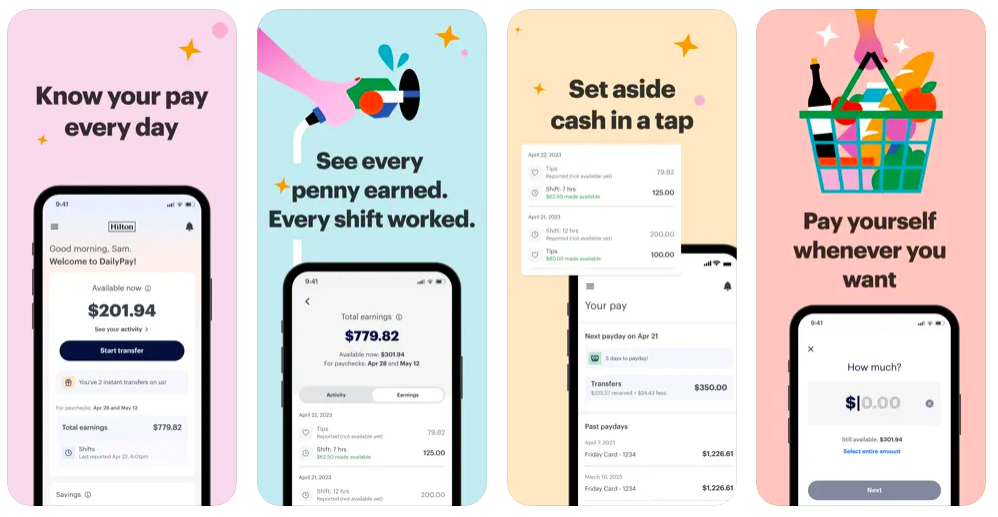

DailyPay

DailyPay partners with employers to give staff access to wages they’ve earned before payday. Employees transfer what they need to a bank account, debit card, or prepaid card at any time, while the rest is deposited on their actual payday.

With added savings features, cash back on purchases, and financial tracking, DailyPay empowers employees to manage cash flow more effectively between pay cycles—provided their company participates in the program.

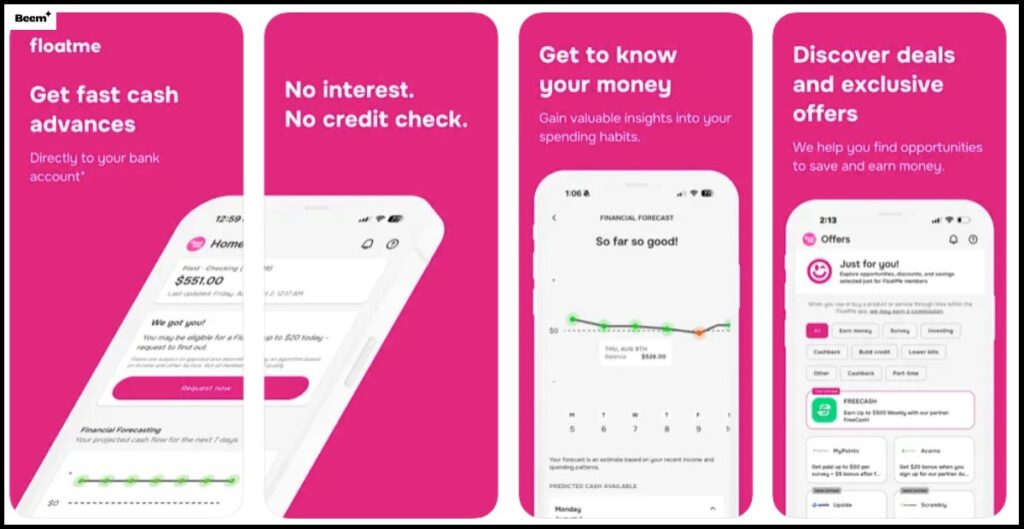

FloatMe

FloatMe is aimed at those needing small, fast cash to avoid overdraft—offering advances from $10 to $100 for a nominal $1.99–$2.99 monthly subscription. By linking your bank, FloatMe anticipates when you’re about to run short and can offer a no-interest advance to bridge the gap.

Its primary focus is on preventing expensive overdraft fees while providing easy access to emergency funding.

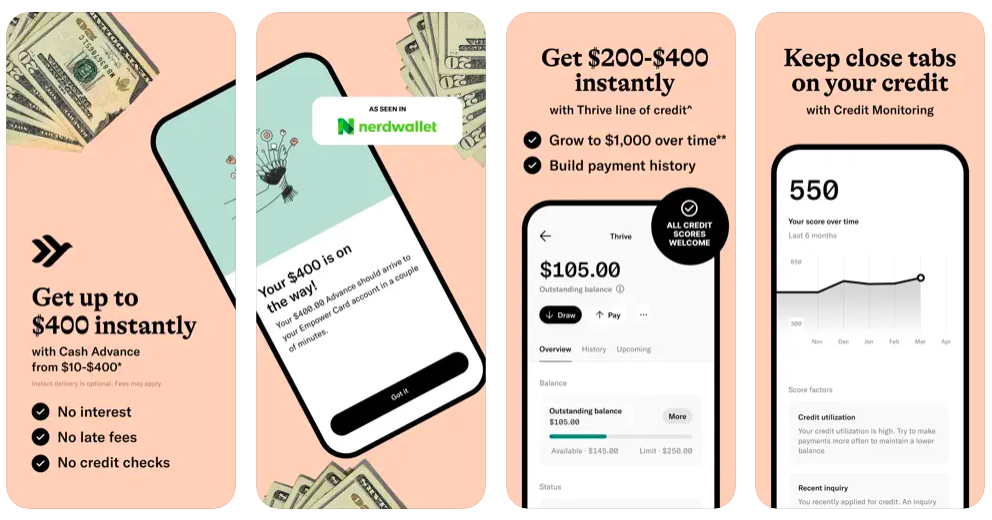

Empower

Empower delivers cash advances up to $400 with quick, automated approval based on your banking habits. Instant funding is available, and features like a rewards banking card, spending and savings automation, and proactive account alerts are included.

Membership may apply, but Empower’s blend of cash advance and everyday banking tasks makes it an all-in-one solution for those seeking an app that helps manage both cash flow and daily finances.

Lenme

Lenme distinguishes itself as a peer-to-peer lending platform where individual users borrow money directly from other app participants. You set your borrowing request and terms, and investors evaluate and fund them at their discretion.

The platform is known for its flexibility, and for providing opportunities both for lenders wanting to earn extra interest and borrowers who may not qualify for traditional credit products.

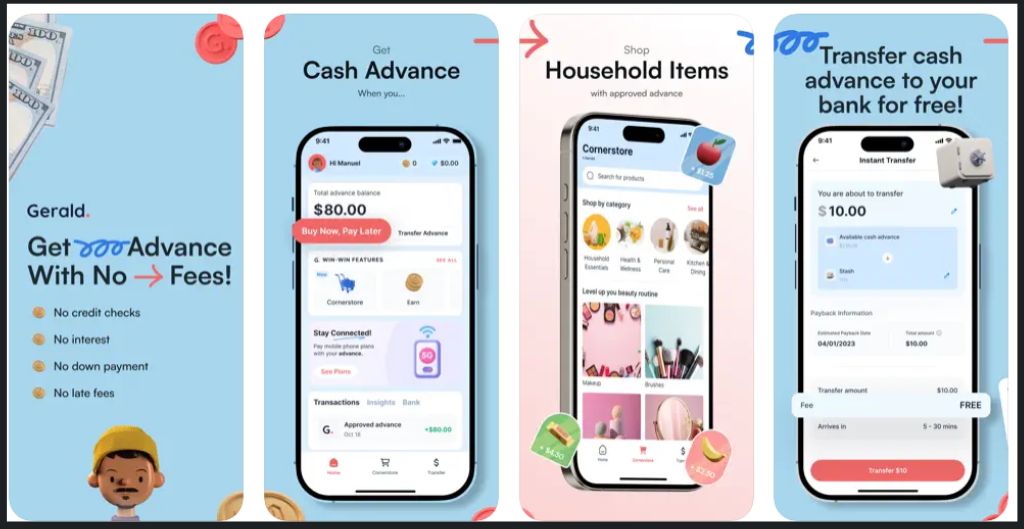

Gerald

Gerald offers advances up to $200 and is designed to help users avoid overdraft, late fees, and missed payments by providing fee-free or low-fee advances. It can integrate buy-now-pay-later functionality and bill payment alongside smart alerts about potential bank overdraft.

With its free approach to advances and focus on financial stability, Gerald is a strong pick for those looking to avoid hidden costs.

Payactiv

Payactiv works through employers to offer staff early wage access and an array of financial wellness tools. By connecting company payroll systems, employees can transfer a portion of their earned income instantly to accounts or cards.

There are also features for budgeting, savings, healthcare benefits, and pay card use, making Payactiv ideal for workers in organizations disrupting traditional payroll cycles.

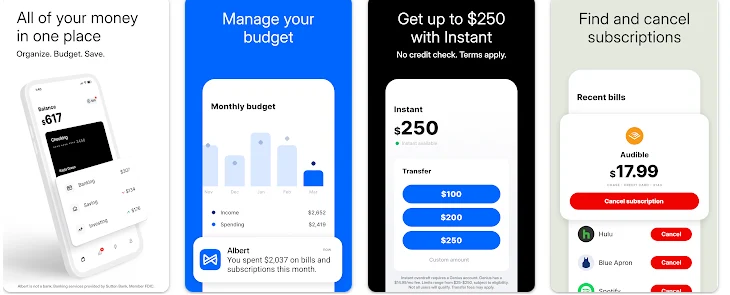

Albert

Albert provides up to $250 cash advances with automated eligibility checks. Users can access additional financial tools like budgeting, personalized savings plans, investing options, and even access to financial advisors.

Many premium features are unlocked with a monthly subscription, and its blend of short-term funding and long-term financial planning is ideal for users craving coaching and investment help as well as instant cash.

SoLo Funds

SoLo Funds operates as a peer-to-peer social lending platform, helping individuals borrow from and lend to one another. Borrowers set their requested amount and timeline, with repayment typically encouraged through “tips” rather than interest.

Lenders pick whom to support, building a community-focused alternative to traditional cash advance apps. With transparent, flexible terms and a reputation system, it’s perfect for users who value social responsibility.

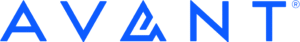

Avant

Aimed at those interested in more substantial financing, Avant provides personal loans and some lines of credit, usually requiring at least a soft credit check. Applications are straightforward and approvals can be fast for qualified borrowers.

While it may have higher borrowing limits than standard advance apps, Avant is best for those who can tolerate more traditional lending requirements and want stable, consistent loan terms.

Oportun

Oportun focuses on providing loans and lines of credit for users with limited or fair credit histories. With flexible terms, manageable payments, and credit bureau reporting, Oportun helps users get access to the credit they need while building or repairing their profile.

The application process can involve a credit check, so it’s especially valuable for users trying to move upward from no or low credit.

Kikoff

Kikoff offers small lines of credit not necessarily tied to cash advance, but designed to help users establish or rebuild credit. It reports all payments to major credit bureaus, so even modest monthly payments can quickly create a positive credit history.

It’s ideal for anyone seeking to boost credit scores, particularly those who’ve struggled to qualify for larger loan products elsewhere.

True Finance

True Finance delivers fast, simple cash advances with quick eligibility and transparent terms. While borrowing limits may be modest, the application process is typically painless—and repayment lines up with your next paycheck.

With minimal paperwork and quick results, True Finance is perfect for users in need of emergency money and who want a straightforward experience.

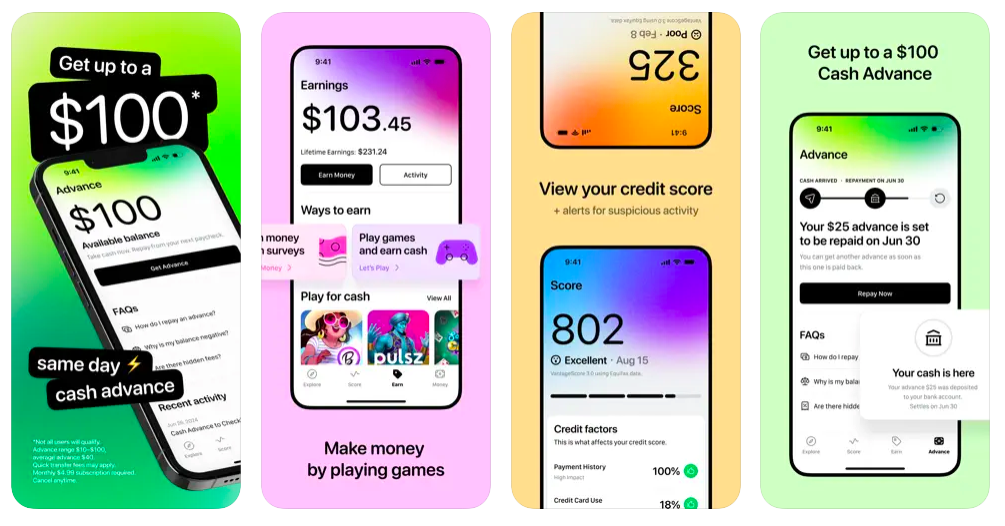

Cashli

Cashli stands out by offering fast cash advances, sometimes with the option to access funds through partnered ATMs. After a quick eligibility check, users receive immediate access to emergency cash, often when traditional institutions would delay.

Its ATM integration makes it an ideal solution for consumers who may not have convenient access to online or digital transfers.

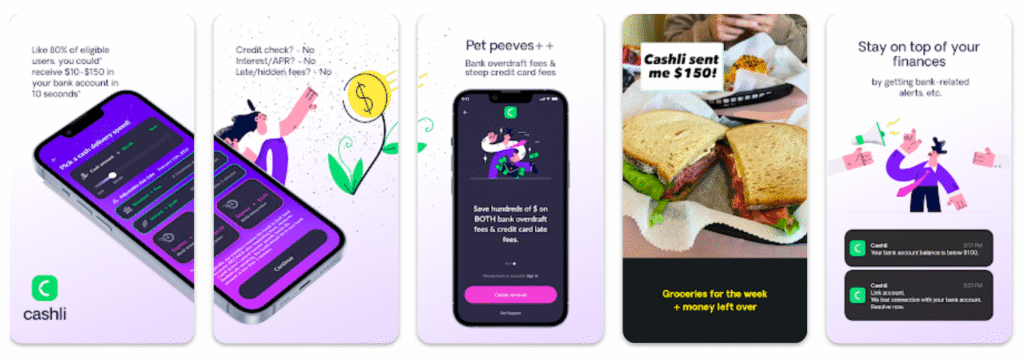

ATM Cash Advance

ATM Cash Advance allows users to withdraw borrowed funds directly from an ATM, bypassing the typical delay of a bank or P2P transfer. The process mimics using a debit card, with fast physical access to cash. Borrowers must still meet certain eligibility and repayment standards but for those who prefer cash-in-hand instantly, it’s a unique and effective service.

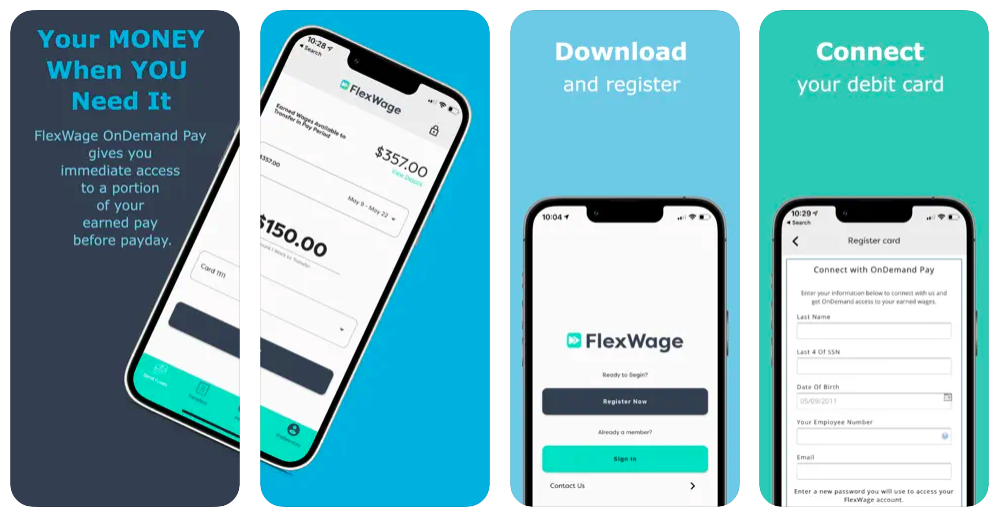

FlexWage

FlexWage partners with employers to provide wage advances and on-demand payroll transfer for employees. Once your company is enrolled, you can access earned wages early without impacting your normal pay schedule.

Integrated seamlessly into payroll systems, FlexWage is most beneficial for employees in need of flexible pay that reflects their real-time earnings and labor.

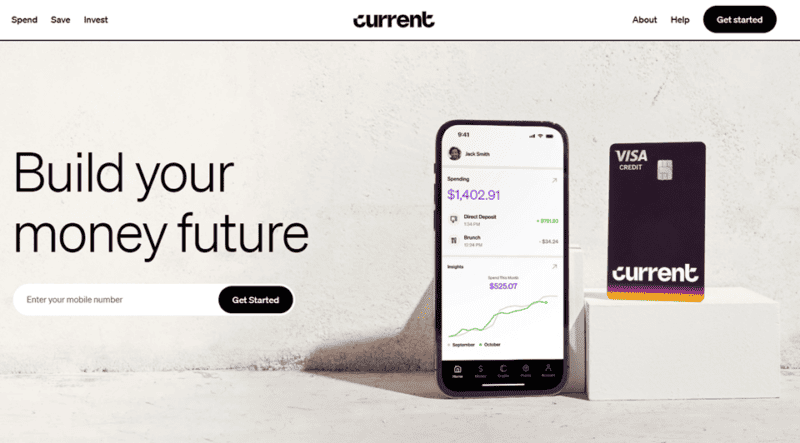

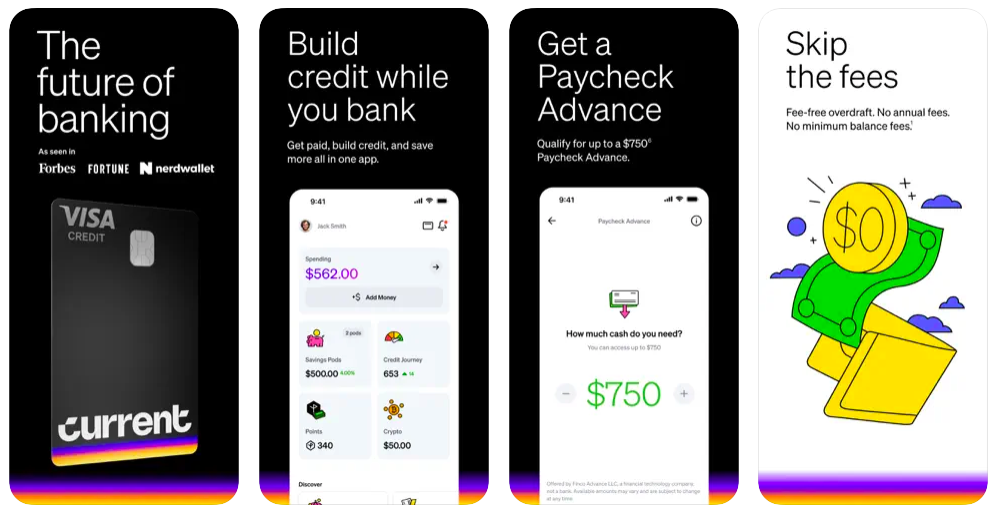

Current

Current functions as a neobank, delivering early direct deposit, overdraft protection up to $200, and smart money management—all from a mobile-first platform.

Users enjoy banking without hidden fees, quick access to advances, and robust budgeting. Especially friendly to younger or digital-native users, Current puts the full banking experience, including advances, in an easy-to-use app.

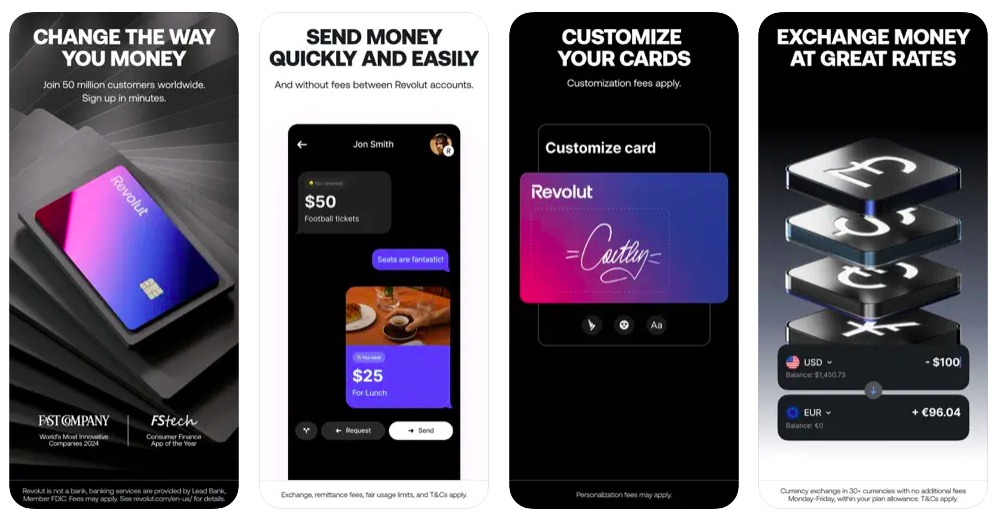

Revolut

Revolut serves as a global digital bank with multi-currency accounts, competitive exchange rates, and spending analytics. While more known for its international features, select markets also offer quick cash advances and overdraft protection.

For frequent travelers or those with broad financial needs including currency exchange and crypto, Revolut provides a truly international solution.

CashNetUSA

CashNetUSA specializes in short-term payday and installment loans, providing qualified users with rapid access to emergency funds. The application and approval process can be completed online in minutes, and funds are commonly disbursed the same day.

While it’s a convenient solution for emergencies, interest rates can be high, making it more suitable for those in dire, short-term need.

STRIX

STRIX combines digital banking with short-term loan solutions, granting users quick access to extra cash and a full suite of neobank features. Account holders typically navigate everything from mobile, benefitting from an all-in-one experience. For users who prefer a frictionless digital approach to both banking and borrowing, STRIX is a strong pick.

Super.com

Super.com offers instant cash advance in addition to a robust ecosystem of financial comparison and savings tools. Users can find not only emergency funds but also compare different financial products to maximize their overall savings.

Its mission is to help users save money at every step, making it great for deal hunters seeking quick cash and long-term value.

Ingo Money App

Ingo Money App allows users to deposit paper checks by taking a photo and to cash out instantly to a bank account or card. For those frequently paid by check or in need of funds outside bank hours, the fee-for-instant option is invaluable.

Its compatibility with various prepaid cards and mobile wallet integrations makes Ingo Money particularly appealing to unbanked or underbanked consumers.

GO2bank

GO2bank is a modern, digital bank with fast cash solutions, offering features such as high-yield savings, up to $200 in overdraft protection, and early direct deposit.

With easy eligibility for small advances and secure banking, GO2bank serves digital-first consumers looking for both speed and financial flexibility.

Pocketly

Pocketly is tailored to college students and young adults, providing instant microloans for those with limited credit or little work history. The application takes minutes, and advances are quickly deposited, helping younger consumers cover expenses or emergencies without turning to high-interest payday lenders.

Rufilo

Rufilo provides fast microloans and cash advances primarily to users in emerging markets. The app offers a seamless application, near-instant approval, and immediate funds for eligible users.

Rufilo addresses the unique needs of borrowers seeking very modest amounts for brief periods, especially those without access to traditional bank lending.

Best Cash Advance App Comparison Table

| App Name | Cash Advance Limit | Credit Check | Speed of Funds | Special Features | Best For |

| Beem | Up to $1,000 | No | Instant | Everdraft™, credit monitoring, insurance | Maximum instant advance with no fees |

| Earnin | Up to $750 | No | Instant (with fee) | Balance Shield, credit report, Tips optional | Wage access before payday |

| Dave | Up to $500 | No | Instant (with fee) | Budgeting, Side gigs, $1/month fee | Budgeting + extra income tools |

| Brigit | Up to $250 | No | Same or next day | Credit Builder, overdraft alerts | Overdraft protection + credit support |

| Chime (SpotMe) | Up to $200 | No | Immediate use | Overdraft protection, early pay | Chime banking users with direct deposit |

| MoneyLion | Up to $500 | No | Instant (with fee) | Investing, saving, credit building | All-in-one banking & credit building |

| Klover | Up to $250 | No | Standard or Instant (with task points) | Points reward system, financial education | Earnings for engagement—not fees |

| DailyPay | Varies (by employer) | No | Same day | Employer-powered wage access | On-demand wages from employer |

| FloatMe | Up to $100 | No | Within hours | Overdraft stop, savings tips | Avoiding overdrafts with low-fee advances |

| Empower | Up to $250 | No | Instant (with fee) | Rewards card, auto-save, alerts | Cash advance + financial automation |

| Lenme | Varies (P2P loans) | Possibly soft | Varies | Peer-to-peer lending, low rates | Borrowing & lending in a community |

| Gerald | Up to $200 | No | Instant available | Overdraft alerts, bill pay sync | Bill support + zero cost advances |

| Payactiv | Employer-based | No | Same day | Budgeting, employee benefits access | Wage access from partnered employers |

| Albert | Up to $250 | No | Within hours | Finance coach, saving, investing | Tips/suggestions + fund access |

| SoLo Funds | Up to $575 | No | Within 1–2 days | Social lending, tipping system | Borrowing from other real users |

| Avant | $2,000+ (personal loans) | Yes (Hard)** | 1–3 days | Personal loans with flexible terms | Long-term borrowing for growing needs |

| Oportun | Loan-specific | Yes (Soft/Hard) | 1–3 days | Credit-building loan options | Fair credit borrowers |

| Kikoff | N/A (Credit builder) | No | N/A | Credit line reporting to bureaus | Boosting or starting credit score |

| True Finance | Small loans | Sometimes | 1–2 days | Simple lending, payday sync | Emergency cash for simple needs |

| Cashli | Small amounts | No | Same day | ATM cash access feature | Physical cash convenience |

| ATM Cash Advance | Varies | Varies | Same day | Cash withdrawal at ATM | Getting cash at ATM when needed |

| FlexWage | Employer-based | No | Same day | Integrated with payroll systems | Staff needing on-demand pay |

| Current | Up to $200 in SpotMe | No | Immediate | Digital banking, early pay | Modern neobank users |

| Revolut | Limited in US | No | Same day/in-app | Currency exchange, global account | Global travelers & freelancers |

| CashNetUSA | $100–$3,000 | Yes (Hard) | Next business day | Payday loans, installment loans | Fast, short-term loans (high interest) |

| STRIX | Varies | Sometimes | Near instant | Neobank features included | All-digital users |

| Super.com | Varies | No | Same day | Instant cash, shopping deals | Saving money and borrowing |

| Ingo Money App | N/A (Check cashing) | No | Instant (with fee) | Cash check with photo upload | Check-based payments & unbanked users |

| GO2bank | Up to $200 | No | Same day | Credit builder, high-yield savings | Digital bank with powerful tools |

| Pocketly | Up to ₹10,000 (India) | No | 1–2 days | Built for students, minimal docs | Student emergency fund |

| Rufilo | ₹5,000–₹25,000 (India) | No | Instant | Minimal paperwork, mobile-first | Small personal loans in minutes |

Note: Advance limits, fees, verification processes, and features may vary by user location and financial profile. Always review each app’s specific terms and conditions before use.

Key Factors to Compare When Choosing a Cash Advance App

When selecting a cash advance app, compare the maximum advance amount, speed of fund delivery, eligibility or credit check requirements, and associated fees. Some apps require a subscription, others use tipping or single transaction fees, and a few offer standard transfers for free.

Also consider value-added features such as credit-building, investing, or budgeting tools, as these can turn a simple cash advance into a stepping stone toward financial stability.

Frequently Asked Questions (FAQs) About Cash Advance Apps Like Borrow Money App

What is the best alternative to a Borrow Money App?

Beem is the best alternative to a borrow money app.

Are cash advance apps safe to use?

Most reputable apps like Beem use strong encryption, keep funds FDIC-insured via partner banks, and uphold privacy policies. Always download from official app stores, read reviews, and avoid sharing excessive permissions.

Which app offers the fastest cash transfer?

Apps like Beem, Floatme, Dave, and Ingo Money App are known for instant or near-instant funding, sometimes for a small fee. For free, most apps deliver in one to three business days.

Conclusion

There are abundant alternatives to the Borrow Money App, each catering to diverse needs—from instant, no-credit-check advances to credit-building, budgeting, and investing features.

Whether you’re looking for immediate cash, a way to avoid overdraft, or tools to strengthen your finances, apps like Beem, Dave, Earnin, and MoneyLion are leading the charge.

Remember to compare features, fees, and limits, and use these apps as a stopgap—not a habit—for the healthiest financial outcomes.